The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the most important paper in financial economics in the last 50 years.” The Center for Applied Quantitative Finance provides the risk-neutral and empirical risk-free interest rates for government bond markets when the government is among the least risky of 183 sovereigns according to the KRIS® default probability service and when those markets have a large amount of bonds outstanding. The CAQF team, under the direction of Professor Robert Jarrow and Dr. Donald R. van Deventer, combines these forward-looking Monte Carlo yield simulations with the no-arbitrage foreign exchange rate model of Amin and Jarrow [1992] to generate both risk-neutral and empirical foreign exchange rates. Using a 14-country “World” interest rate database with more than 110,000 observations, the CAQF team has derived a 12-factor World HJM parameter set of stochastic volatility functions and foreign exchange rate dynamics.

A summary simulation description and summary distributions for 3-month yields and 10-year yields are available for key markets in Asia (Australia, Japan, New Zealand, Singapore, and Thailand), North America (Canada and the United States) and Europe (Germany, Sweden, and the United Kingdom). Full simulation output is available via the KRIS risk data service. Links to this week’s results are given below:

- Scenarios: 75,000

- Time step length: 91 days

- Time Horizon: 10 to 30 years

Australian Government Securities Yields and Australian Dollar Exchange Rates

- PDF Simulation Summary: https://www.kamakuraco.com/wp-content/uploads/2025/06/WeeklyKRISAUDForecast20250620.pdf

- Excel 3-Month Bill Distribution: SASaus3m20250620

- Excel 5-Year Bond Yield Distribution: SASaus5y20250620

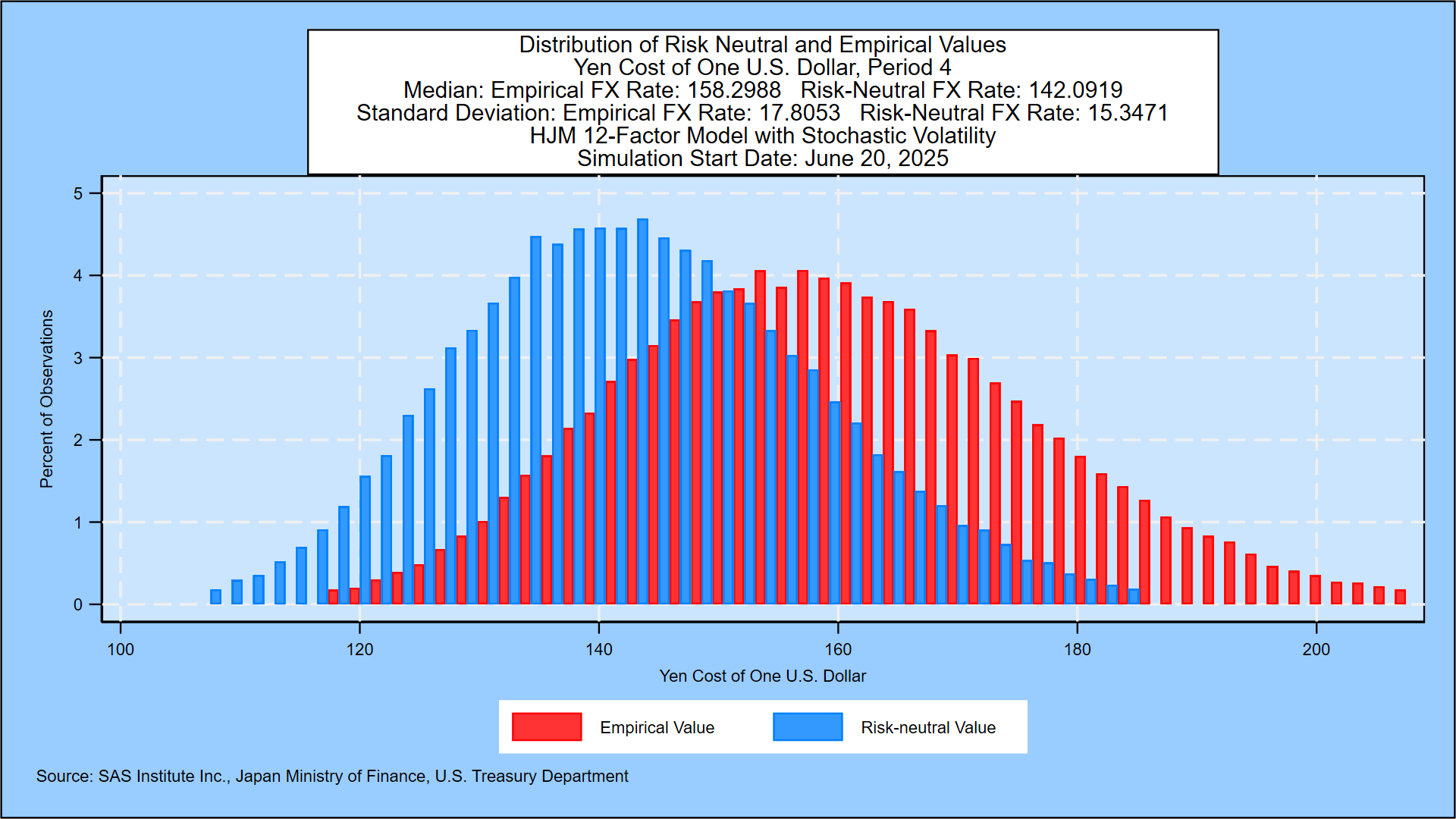

Japanese Government Bond Yields and Yen Exchange Rates

- PDF Simulation Summary: https://www.kamakuraco.com/wp-content/uploads/2025/06/WeeklyKRISJGBForecast20250620.pdf

- Excel 3-Month Bill Distribution: SASdistributionJGB3m20250620

- Excel 10-Year Bond Yield Distribution: SASdistributionJGB10y20250620

New Zealand Treasury Yields and New Zealand Dollar Exchange Rates

- PDF Simulation Summary: https://www.kamakuraco.com/wp-content/uploads/2025/06/WeeklyKRISNZDForecast20250620.pdf

- Excel 3-Month Bill Distribution: SASNZL3m20250620

- Excel 5-Year Bond Yield Distribution: SASNZL5y20250620

Singapore Government Bond Yields and Singapore Dollar Exchange Rates

- PDF Simulation Summary: https://www.kamakuraco.com/wp-content/uploads/2025/06/WeeklyKRISSGDForecast20250620.pdf

- Excel 3-Month Bill Distribution: SASsgp3m20250620

- Excel 10-Year Bond Yield Distribution: SASsgp10y20250620

Thai Government Bond Yields and Thai Baht Exchange Rates

- PDF Simulation Summary: https://www.kamakuraco.com/wp-content/uploads/2025/06/WeeklyKRISTHBForecast20250620.pdf

- Excel 3-Month Bill Distribution: SAStha3m20250620

- Excel 10-Year Bond Yield Distribution: SAStha10y20250620

German Bund Yields and Euro Exchange Rates

- PDF Simulation Summary: https://www.kamakuraco.com/wp-content/uploads/2025/06/WeeklyKRISBundForecast20250620.pdf

- Excel 3-Month Bill Distribution: SASDEU3m20250620

- Excel 10-Year Bond Yield Distribution: SASDEU10y20250620

Swedish Government Bond Yields and Swedish Krona Exchange Rates

- PDF Simulation Summary: https://www.kamakuraco.com/wp-content/uploads/2025/06/WeeklyKRISSEKForecast20250620.pdf

- Excel 3-Month Bill Distribution: SASswe3m20250620

- Excel 5-Year Bond Yield Distribution: SASswe5y20250620

United Kingdom Gilt Yields and Pound Exchange Rates

- PDF Simulation Summary: https://www.kamakuraco.com/wp-content/uploads/2025/06/WeeklyKRISGiltForecast20250620.pdf

- Excel 3-Month Bill Distribution: SAS3monthGilt20250620

- Excel 10-Year Bond Yield Distribution: SAS10yearGilt20250620

Canadian Government Bond Yields and Canadian Dollar Exchange Rates

- PDF Simulation Summary: https://www.kamakuraco.com/wp-content/uploads/2025/06/WeeklyKRISCADForecast20250620.pdf

- Excel 3-Month Bill Distribution: SASCAD3m20250620

- Excel 5-Year Bond Yield Distribution: SASCAD5y20250620

United States Treasury Bond Yields

- PDF Simulation Summary: https://www.kamakuraco.com/wp-content/uploads/2025/06/WeeklyKRISTreasuryForecast20250620.pdf

- Excel 3-Month Bill Distribution: SAS3monthUST20250620

- Excel 10-Year Bond Yield Distribution: SAS10yearUST20250620

Sample Simulation Summary: