TROUBLED COMPANY INDEX®

The Troubled Company Index ® measures the percentage of 42,500 public firms in 76 countries that have an annualized one-month default risk of over one percent.

DAILY

KRIS Default Probabilities versus

Legacy Ratings

SAS Daily Bond Performance Attribution

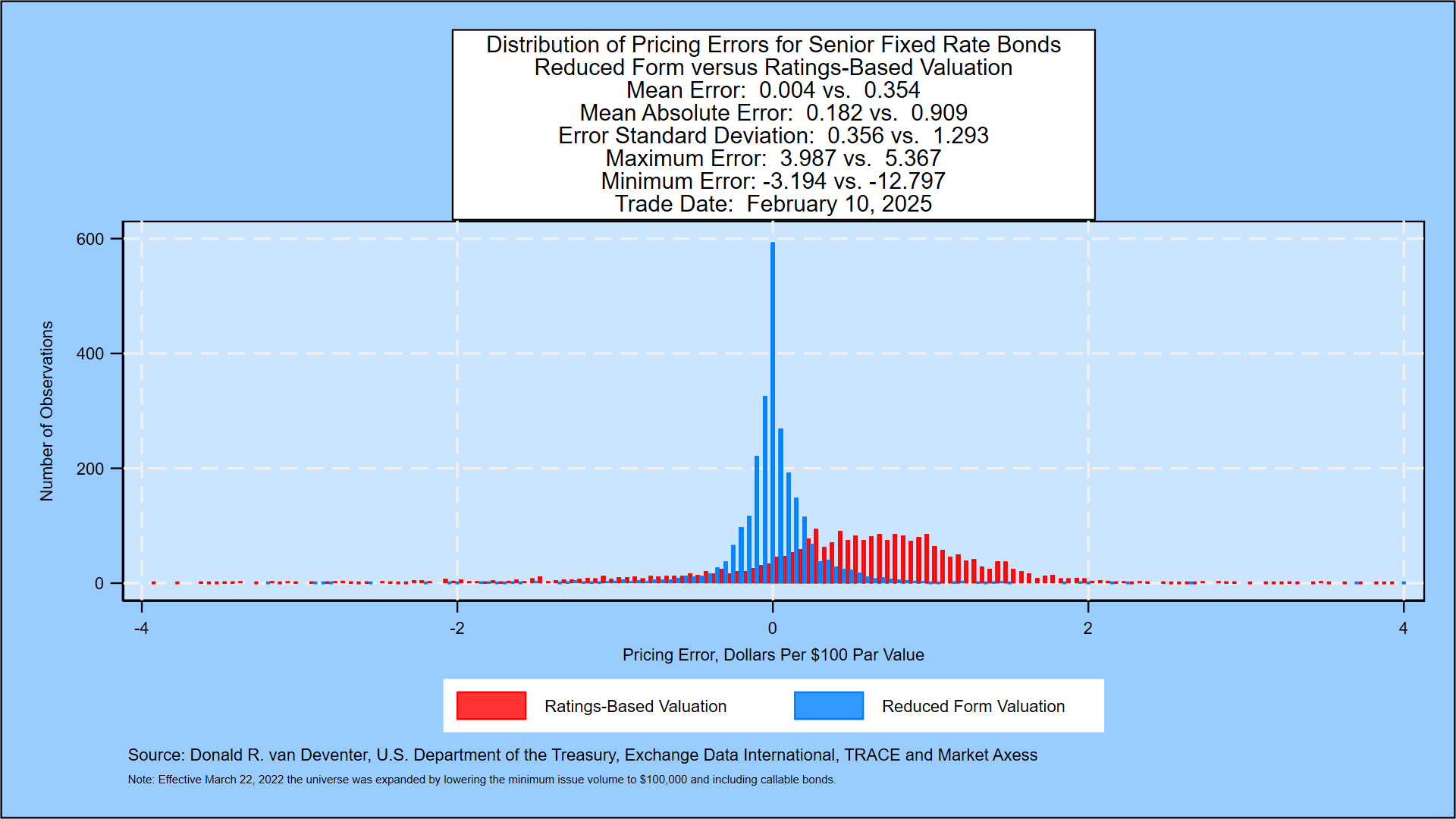

KRIS Daily Default Probability and

Bond Cross-Validation

RESEARCH

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, October 31, 2025

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the most important paper in financial economics in the last 50 years.” The Center for Applied Quantitative Finance provides the risk-neutral and...

SAS Weekly Treasury Simulation, October 31, 2025: One-Month Forward T-Bill Rates Peak at 5.85%, Up 0.16%

Summary The most likely range for 3-month bill yields in 10 years remained in the 0% to 1% range this week. The probability of being in this range is 0.18% higher than the probability of the 1% to 2% range. Treasury 2-year yields moved to 3.6% this week from 3.46%...

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, October 17, 2025

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the most important paper in financial economics in the last 50 years.” The Center for Applied Quantitative Finance provides the risk-neutral and...

SAS Weekly Treasury Simulation, October 17, 2025: Ten Year Range for the 3-Month Bill Yield 0% to 2%

Summary The most likely range for 3-month bill yields in 10 years remained in the 0% to 1% range this week. The probability of being in this range is just 0.02% higher than the probability of the 1% to 2% range. Treasury 2-year yields moved to 3.46% this week from...

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, October 10, 2025

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the most important paper in financial economics in the last 50 years.” The Center for Applied Quantitative Finance provides the risk-neutral and...

COMMENTARY

Record Highs

October was another month for the history books. Equity markets notched new record highs: S&P 500 added $17 trillion since the April lows, Nvidia became the first $5T market cap company, Amazon surged almost 10% post earnings recording largest one-day market cap...

Non-conventional Fed actions lowered default risk in the short-term—but what’s coming next?

NEW YORK October 1, 2025: The U.S. markets have become conditioned to seeing the Federal Reserve step in whenever negative conditions appear to worsen. Of course, many see the Fed’s interventions as a safety net – as indeed they are during times of crisis. But...

Tariffs: Learning from History to Chart a Path to the Future

NEW YORK September 2, 2025: Successful investing is the art of filtering out noise so that you can focus on signals leading to long-term gains. But how do you do that when markets are constantly jolted by changing tariffs—and shifting sentiment about their potential...

Out of the Shadow of Government Debt

NEW YORK August 1, 2025: As the dog days of summer drag on in the Northern Hemisphere, the dynamics of government debt and credit risk are raising vexing questions, some of which seem to defy conventional analysis. Part of the confusion arises from the Federal Reserve...

From Integration to Separation: Risks and Opportunities from U.S.- China Decoupling

NEW YORK July 1, 2025: The history of U.S.-China trade in some ways mirrors the history of China itself: periods of stability and growth punctuated by radical shifts that have realigned industries, financial markets, and the actions of central banks. We are in the...

EVENTS

- September

- 07–10 SEP | 2025 MSATA (Midwestern States) Annual Meeting

- 09 SEP | SAS Innovate on Tour, Mexico City

- 11 SEP | SAS Innovate on Tour, Sao Paulo

- 15–16 SEP | MoneyLIVE North America

- 16-17 SEP | Nordic Financial Crime & Sanctions Forum

- 17 SEP | Palm Beach Economic Crimes Unit 2025 Financial Institution and Law Enforcement Annual Training Seminar

- 22–24 SEP | MoneyLIVE North America

- 30 SEP | SAS Innovate on Tour, Los Angeles

- 30 SEP | ACAMS Carolinas Chapter, 5th Annual AML and OFAC Symposium

- October

- 02 OCT | ACAMS Carolinas Chapter Symposium | Charlotte, NC (Banking-AML/Fraud)

- 08–09 OCT | RiskLive NA

- 14–16 OCT | ITC Vegas

- 29–30 OCT | Balance Sheet Management USA