TROUBLED COMPANY INDEX®

The Troubled Company Index ® measures the percentage of 42,500 public firms in 76 countries that have an annualized one-month default risk of over one percent.

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, February 27, 2026

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the most important paper in financial economics in the last 50 years.” The Center for Applied Quantitative Finance provides the risk-neutral and...

SAS Weekly Treasury Simulation, February 27, 2026: 3-Month Bill Decline Stays on Track to 1% to 2% in 30 Months

Summary The most likely range for 3-month bill yields in 10 years remained at the 1% to 2% range this week. The probability of being in this range is only 0.06% higher than the probability of being in the 0% to 1% range. Treasury 2-year yields moved to 3.38% this week...

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, February 20, 2026

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the most important paper in financial economics in the last 50 years.” The Center for Applied Quantitative Finance provides the risk-neutral and...

SAS Weekly Treasury Simulation, February 20, 2026: Quantifying the Fall in Treasury Yields

Summary The most likely range for 3-month bill yields in 10 years remained at the 1% to 2% range this week. The probability of being in this range is only 0.04% higher than the probability of being in the 0% to 1% range. Treasury 2-year yields moved to 3.48% this week...

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, February 13, 2026

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the most important paper in financial economics in the last 50 years.” The Center for Applied Quantitative Finance provides the risk-neutral and...

The Credibility Risk in Credit

February saw a modest widening in public credit spreads: the ICE BofA U.S. Corporate (IG) OAS widened from 75 bps at January month-end to 86 bps at February month-end, while the ICE BofA U.S. High Yield OAS widened from 288 bps to 312 bps. Equity markets were little...

Divergence in Credit Conditions: Index-Level Resilience vs Typical-Firm Strain

Markets opened 2026 with risk appetite intact, and early performance patterns suggested leadership may be broadening beyond the mega-caps (January: S&P 500 +1.4% vs Russell 2000 +5.3%). Risk assets continued to reward scale, liquidity, and perceived cash flow...

The Narrowing Definition of “Winner”

December capped a year in which headline growth and risk-on positioning coexisted with rising under-the-surface strain—a late-cycle mix that kept markets calm while widening the gap between credit “winners” and “losers.” Continuing the trends of outperformance, the US...

Three Years Post ChatGPT

November 30th marked the three-year anniversary since the public release of ChatGPT. Back then, the S&P 500 stood at 3,950 compared to its most recent close of 6,849 – a 73% increase and $24T gain in total market cap. Meanwhile, Nvidia’s most recent net income...

Record Highs

October was another month for the history books. Equity markets notched new record highs: S&P 500 added $17 trillion since the April lows, Nvidia became the first $5T market cap company, Amazon surged almost 10% post earnings recording largest one-day market cap...

ANALYTICS

KRIS Default Probabilities versus Credit Ratings

SAS Daily Bond Performance Attribution

KRIS Daily Default Probability and

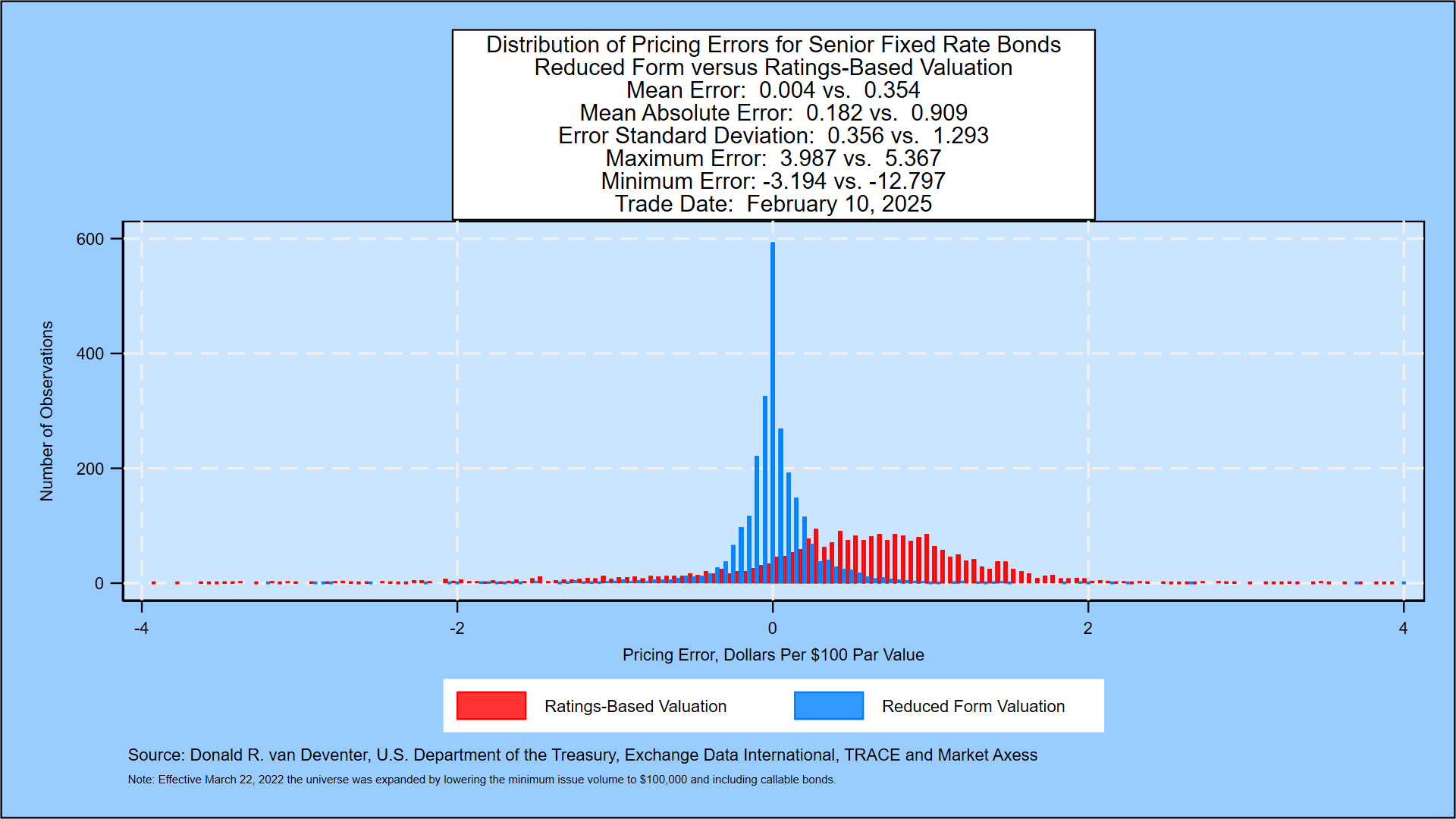

Bond Cross-Validation

EVENTS

- February

- 24 FEB | Banking on AI: The 2026 Maturity Pivot

- April

- 27 – 30 APR | SAS Innovate 2026

- May

- 14 MAY | BattleFin Discovery Day New York

- September

- 24 SEP | BattleFin Discovery Day London