NEW YORK, July 2, 2024: Markets ended in the black this quarter, with the S&P 500 up 4% for the quarter and 15.29% year-to-date. The S&P World Index was up 0.82% for the quarter and 6.75% for the year-to-date. The S&P 500 top 50 were up 9% in the second quarter, while the S&P MidCap 400 and the S&P SmallCap 600 were both down 3%.

From a sector standpoint, information technology and communications were the leaders for the quarter, up 14% and 9%, respectively. The worst performing sectors were materials and industrials, down 4.5% and 2.9%, respectively. The S&P Asia 50 Index was up 11.61% for the quarter, while the S&P Latin America 40 was down 10.13%.

A handful of large companies increasingly dominate the performance of the market. We see these companies prospering despite high interest rates, while smaller firms struggle and the middle gets squeezed. This divergence of fortunes is evident both in the overall economy and across many industry sectors. To sum up, the “great bifurcation” in the markets continues, and we do not expect that to change in the near term.

Our default probability models are showing a similar bifurcation. The overall index continues to show a benign risk environment. Interestingly, the percentage of companies with a one-month default probability above 10% increased, requiring anlaysts to look at the details behind the broad indices.

With low volatility in the markets, as well as in our default probability index, we reiterate our warning from last month to focus on the fundamentals, as losses tend to come from a small number of loans or investments.

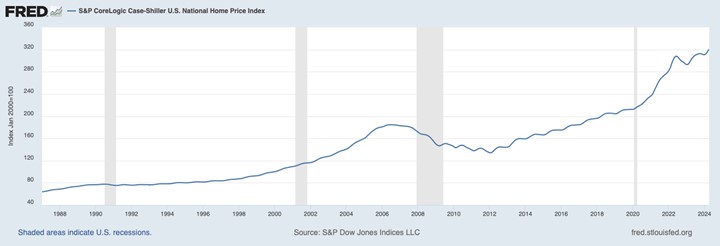

An interesting sector to study in this environment is home building. Enduringly high interest rates, which are now hovering around 7%, have reduced home affordability and cooled single family sales. Hybrid work is reduceing corporate relocations andlowering the supply of homes for sale. In addition, homeowners are unwilling to give up their 3% mortgages, further reducing supply. We are seeing a drop in both existing and new home sales, although the data used in reports has been noisy and contains some sizeable adjustments. What is certain is that the median price of a single family home has hit new a record, as you can see in the Case-Shiller Home Price Index below.

Figure 1: S&P CoreLogic Case-Shiller U.S. National Home Price Index

On the multifamily housing front, leading economists have been expecting the cost of rent to decline for a number of years—but instead, it has increased by at least 0.4% per month for 33 consecutive months, according to data from the Bureau of Labor Statistics. If we are not building enough housing and rates stay high, their impact on rent inflation will challenge policy makers at the Federal Reserve. In addition to housing supply, we need to factor in demand and policy choices related to the growing migrant population that ultimately needs to be housed. The good news is that building completions–especially in multifamily sector–are overtaking housing starts, which could offer some relief from rent inflation later this year.

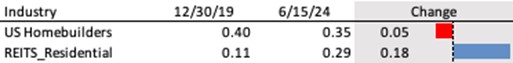

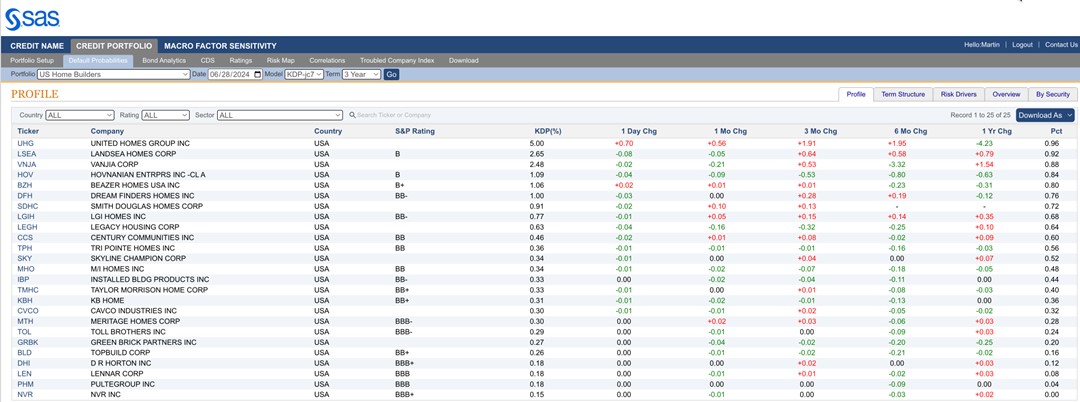

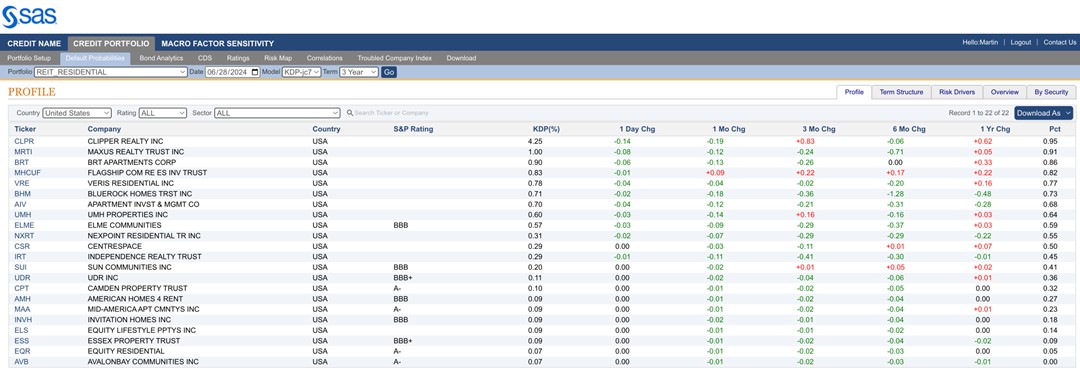

Given the challenges of the housing sector, we take a look at the default risk for major home builders and residential REITs as proxies for the multifamily segment. Using the 3-year KDP as an indicator for default outlook, we can see in Table 1 that both the mean and median 3-year KDPs for home builders are lower today than they were in 2019, while the opposite is true for REITs. It should also be noted that the data is skewed by a handful of companies in both sectors, so we refer readers to Tables 2 and 3 to view details for the two segments. Further, other REIT sectors are experiencing stress and we will examine those in our next credit conditions release.

Table 1: – Change in 3-Year KDP among Home Builders and REITS

The conclusion is that firms are navigating the housing challenges well. Our KDPs show that individual firm risks are generally well managed, and investors and lenders should be able to easily differentiate lower-risk players within a sector who are facing unusual economic challenges and individual firms that require more detailed study to understand why they have higher risk levels. In this case, the bifurcation is caused by a handful of firms that are driving up the sector’s default probabilities.

Table 2: Default Risk for Homebuilders, Measured by 3-Year KDP

Table 3: – Default Risk for Resdiential REITs, Measured by 3-Year KDP

Contemporaneous Credit Conditions

The Kamakura Troubled Company Index® closed the month at 8.63%, down 0.09% from the prior month. The index measures the percentage of 42,500 public firms worldwide with an annualized one-month default probability of over 1%. An increase in the index reflects declining credit quality, while a decrease reflects improving credit quality.

At the end of June, the percentage of companies with a default probability between 1% and 5% was 6.36%. The percentage with a default probability between 5% and 10% was 1.16%. Those with a default probability between 10% and 20% amounted to 0.87% of the total; and those with a default probability of over 20% amounted to 0.24%. For the month, short-term default probabilities ranged from a low of 8.62% on June 13 to a high of 8.84% on June 25. There were eight defaults in our coverage universe, with three in China, two in the UK, and one each in Korea, Poland the United States.

Figure 2: Troubled Company Index®, June 28, 2024

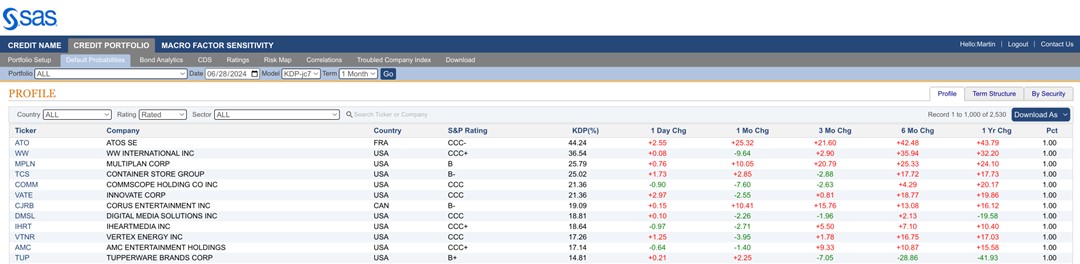

At the end of June, the riskiest 1% of rated public firms within the coverage universe included 10 companies in the U.S. and one each in Canada and France. The riskiest firm was Atos SE (EPA:ATO), with a one-month KDP of 44.24%, up 25.32% for the month. Atos SE is a global technology firm involved in digital transformation solutions. It operates in in 69 countries with 95,000 employees and €11 billion in revenue. In June, the firm announced an initial debt restructuring and an interim financiang proposal, and at the end of the month, two directors resigned.

Table 4: Riskiest Rated Companies Based on 1-Month KDP, June 28, 2024

The Kamakura Expected Cumulative Default Rate, the only daily index of credit quality of rated firms worldwide, shows the one-year rate unchanged at 0.57%, with the 10-year rate down 0.11% at 9.29%.

Figure 3: Expected Cumulative Default Rates, June 28, 2024

About the Troubled Company Index

The Kamakura Troubled Company Index® measures the percentage of 42,500 public firms in 76 countries that have an annualized one-month default risk of over one percent. The average index value since January 1990 is 14.13%. Since July 2022, the Kamakura index has used the annualized one-month default probability produced by the KRIS version 7.0 Jarrow-Chava reduced form default probability model, a formula that bases default predictions on a sophisticated combination of financial ratios, stock price history, and macro-economic factors.

The KRIS version 7.0 models were developed using a data base of more than 4 million observations and more than 4,000 corporate failures. A complete technical guide, including full model test results and key parameters, is provided to subscribers. Available models include the non-public-firm default model, the U.S. bank model, and the sovereign model.

The version 7.0 model was estimated over the period from 1990, through the Great Recession and ending in February 2022. The 76 countries currently covered by the index are Argentina, Australia, Austria, Bahrain, Bangladesh, Belgium, Belize, Botswana, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Ghana, Greece, Hungary, Hong Kong, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Jordan, Kenya, Kuwait, Luxembourg, Malaysia, Malta, Mauritius, Mexico, Nigeria, the Netherlands, New Zealand, Norway, Oman, Pakistan, Peru, the Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sri Lanka, Sweden, Switzerland, Tanzania, Taiwan, Thailand, Turkey, the United Arab Emirates, Uganda, the UK, the U.S., Vietnam and Zimbabwe.

About SAS

SAS is the leader in analytics. Through innovative software and services, SAS empowers and inspires customers around the world to transform data into intelligence. SAS gives you THE POWER TO KNOW®.

Editorial contacts:

- Martin Zorn – Martin.Zorn@sas.com

- Stas Melnikov – Stas.Melnikov@sas.com