Summary The Bund 2-year/10-year spread widened to a negative 47.8 basis points from negative 42.2 basis points last week As a...

CONNECT ME

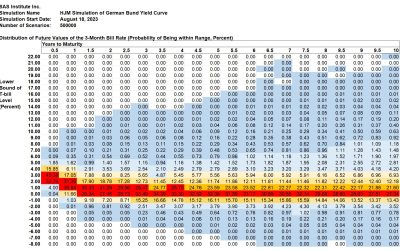

SAS Weekly Euro Zone Forecast, August 18, 2023: Peak in Bund 1-Month Forward Rates Drops to 3.52%

Author’s Note This simulation has been done jointly with a U.S. Treasury yield simulation in a way that reflects the correlation...

SAS Weekly Euro Zone Forecast, August 11, 2023: 32.8% Probability that Negative 2-year/10-year Bund Spread Ends by February

Author’s Note This simulation has been done jointly with a U.S. Treasury yield simulation in a way that reflects the correlation...

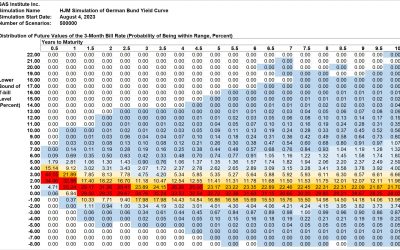

SAS Weekly Euro Zone Forecast, August 4, 2023: 20.4% Probability that Negative 2-year/10-year Bund Spread Ends by February

Author’s Note This simulation has been done jointly with a U.S. Treasury yield simulation in a way that reflects the correlation...

SAS Weekly Euro Zone Forecast, July 28, 2023: Declining Bund Short Rates to Follow a Near-Term Peak

Author’s Note This simulation has been done jointly with a U.S. Treasury yield simulation in a way that reflects the correlation...

SAS Weekly Euro Zone Forecast, July 7, 2023: Higher Bund Yields and a Narrowing 2-year/10-year Bund Yield Spread

This week’s 2-year/10-year Bund yield spread is a negative 66.5 basis points, compared to a negative 86.2 basis points last...

SAS Weekly Euro Zone Forecast, June 30, 2023: Inverted Bund Yields Very Likely to Continue Well Into 2024

This week’s simulation shows that the current negative 2-year/10-year Bund yield spread currently a negative 86.2 bsis points,...

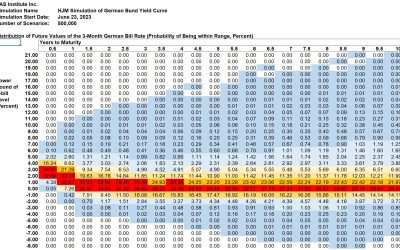

SAS Weekly Euro Zone Forecast, June 23, 2023: Inverted Bund Yields Likely to Persist into 2024

This week’s simulation shows that the current negative 2-year/10-year Bund yield spread is very likely to persist at least...

A 15-Factor Heath, Jarrow, and Morton Stochastic Volatility Model for the German Bund Yield Curve, Using Daily Data from August 7, 1997 through December 31, 2022

Daniel Dickler, Robert A. Jarrow, Stas Melnikov, Alexandre Telnov, Donald R. van Deventer, and Xiaoming Wang[1] First Version:...

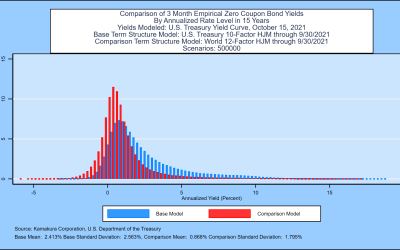

A 12-Factor Heath, Jarrow, and Morton Stochastic Volatility Model For 13-Country `World’ Government Bonds, Using Daily Data from January 1, 1962 through September 30, 2021

Donald R. van Deventer[1] First Version: October 19, 2021 This Version: October 21, 2021 ABSTRACT Please note: Kamakura...

A 15-Factor Heath, Jarrow, and Morton Stochastic Volatility Model for the German Bund Yield Curve, Using Daily Data from August 7, 1997 through September 30, 2021

Donald R. van Deventer[1] First Version: October 6, 2021 This Version: October 6, 2021 ABSTRACT Please note: Kamakura...