NEW YORK: Sept. 3, 2024: Jackson Hole, Wyoming is a place of great beauty, as well as the site of the annual policy symposium hosted by the Federal Reserve Bank of Kansas City. This year’s focus on monetary policy is especially significant because inflation has slowed against the backdrop of economic softness. The location of the meeting may be equally significant. Billionaires recently chased the millionaires out of Jackson Hole. They, in turn, were accused of chasing ordinary workers over the mountain to Idaho. This is a fitting metaphor for the continued bifurcation we are seeing in the economic numbers, in which the disaggregation of “averages” becomes critical to understanding who is doing well and who is struggling. It is a great time to remember one of the most significant speeches given at the symposium–in 2012 by Andrew Haldane, whose “dog and frisbee” analogy emphasized the need for straightforward and simple measurements of risk.

This year, one of the most closely watched and studied set of remarks came from Fed Chairman Jerome Powell, who said, “My confidence has grown that inflation is on a sustainable path back to 2%.” He further stated that “The time has come for policy to adjust.” It was in essence a victory proclamation against inflation, and a definitive signal that interest rate cuts are coming. It was also a vote of confidence for a soft landing, albeit with a rising downside risk to employment. This was very much a pivot, and a reinforcement of the Fed’s dual mandate to minimize employment risks and stabilize prices.

To understand the Fed’s current actions in context, we must delve into the untold story. Hindsight now shows us that supply chain problems and energy prices were the transient part of inflation. It was fiscal and monetary policy that created the persistent part. The positive part of this story is that the inflationary expectations did not get embedded into salaries (i.e., preventing the price-wage spiral). But that also means that inflation has reduced real disposable income.

Up to this point, spending has held up, for various reasons. First it was Covid-related government payments; then there was a drawdown of savings. This was followed by increased borrowing, especially through credit cards and buy-now-pay later schemes. This borrowing was heavily weighted in the middle and working classes, who did not benefit as much as others from a booming stock market and increased home values.

Turning our attention to the capital markets, we have seen the bond market expand dramatically since the Great Recession along with the expansion of private credit. This expansion of liquidity was made possible in part by the expansion of the Fed’s balance sheet, as you can clearly see in Figures 1 and 2 below. Fiscal policy has been primarily funded through government debt, as shown in Figure 3.

Figure 1: Federal Reserve Balance Sheet, August 21, 2024

Figure 2: US Corporate Bond Market Expansion

Source: SIFMA, The Federal Reserve

Figure 3: US Government Debt

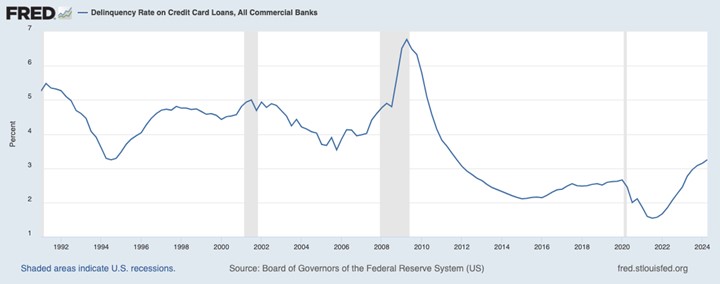

What are the implications of this year’s symposium? When the Fed cuts short-term interest rates, they will likely continue to shrink the balance sheet. At the fiscal policy level, it is unlikely that the government will reduce spending, which will result in increased borrowing, higher taxes, or some combination of each. The effects of fiscal and monetary policy will be reduced liquidity in the markets and rate pressure on the long end of the interest curve, which will occur at the same time the Fed is cutting short-term rates. At the household level, we are seeing increased delinquencies in credit card and auto debt. In fact, credit card delinquencies are now at a 12-year high and have been rising at the highest pace since the Global Financial Crisis. The consumer is tapped out and that will begin to strain corporate earnings.

Figure 4: Delinquency Rate on Credit Card Loans

The post-Covid environment has seen a decoupling of traditional correlations, and that is likely to continue in the post-inflationary period. As expected, we are seeing a steepening of the yield curve, however, the traditional relationship between an inverted curve and recessionary conditions has changed. Earning announcements from Walmart, Home Depot and Dollar General are signaling a pullback in consumer spending, or at least a change of focus toward value. The credit cycle also has not followed the path of recent history, in part because of ultralow rates, but also because of tremendous market liquidity. Equity sector rotations first saw money move into large caps, as they were the most insulated from rising rates. Now, equities are moving to small- and mid-caps, since these sectors are expected to benefit the most from falling short-term rates. The unanswered question is what impact will the Fed moves have on market liquidity.

As risk managers, we do not pretend to predict the future, but rather, determine how to hedge its risks. The current financial environment—especially the potential breakdown in normal factor relationships—calls for increased vigilance and careful model management. Portfolio managers should also keep a keen eye on fundamental analysis, since risks are largely idiosyncratic during this period of transition.

Contemporaneous Credit Conditions

The Kamakura Troubled Company Index® closed the month at 9.07%, up 0.41% from the prior month. The index measures the percentage of 42,500 public firms worldwide with an annualized one-month default probability of over 1%. An increase in the index reflects declining credit quality, while a decrease reflects improving credit quality.

At the end of August, the percentage of companies with a default probability between 1% and 5% was 6.62%. The percentage with a default probability between 5% and 10% was 1.34%. Those with a default probability between 10% and 20% amounted to 0.82% of the total; and those with a default probability of over 20% amounted to 0.29%. For the month, short-term default probabilities ranged from a low of 8.95% on August 1 to a high of 11.03% on August 5. There were 20 defaults in our coverage universe, with ten in China, three in the United States and one each in Australia, Brazil, Denmark, Italy, Kyrgyzstan, Sweden and the UK.

Figure 5: Troubled Company Index®, August 30, 2024

At the end of August, the riskiest 1% of rated public firms within the coverage universe as measured by 1-year default probability included 10 companies in the U.S. and one each in Brazil,Canada and France. The riskiest firm was the Canadian communications firm Corus Entertainment Inc. (TO:CJRB), with a one-month KDP of 38.25%, up 1.64% for the month.

Table 1: Riskiest Rated Companies Based on 1-Year KDP, August 30, 2024

The Kamakura Expected Cumulative Default Rate, the only daily index of credit quality of rated firms worldwide, shows the one-year rate of 0.55% unchanged from the prior month, with the 10-year rate down 1.65% at 7.51%.

Figure 6: Expected Cumulative Default Rates, August 30, 2024

About the Troubled Company Index

The Kamakura Troubled Company Index® measures the percentage of 42,500 public firms in 76 countries that have an annualized one-month default risk of over one percent. The average index value since January 1990 is 14.10%. Since July 2022, the Kamakura index has used the annualized one-month default probability produced by the KRIS version 7.0 Jarrow-Chava reduced form default probability model, a formula that bases default predictions on a sophisticated combination of financial ratios, stock price history, and macro-economic factors.

The KRIS version 7.0 models were developed using a data base of more than 4 million observations and more than 4,000 corporate failures. A complete technical guide, including full model test results and key parameters, is provided to subscribers. Available models include the non-public-firm default model, the U.S. bank model, and the sovereign model.

The version 7.0 model was estimated over the period from 1990, through the Great Recession and ending in February 2022. The 76 countries currently covered by the index are Argentina, Australia, Austria, Bahrain, Bangladesh, Belgium, Belize, Botswana, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Ghana, Greece, Hungary, Hong Kong, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Jordan, Kenya, Kuwait, Luxembourg, Malaysia, Malta, Mauritius, Mexico, Nigeria, the Netherlands, New Zealand, Norway, Oman, Pakistan, Peru, the Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sri Lanka, Sweden, Switzerland, Tanzania, Taiwan, Thailand, Turkey, the United Arab Emirates, Uganda, the UK, the U.S., Vietnam and Zimbabwe.

About SAS

SAS is the leader in analytics. Through innovative software and services, SAS empowers and inspires customers around the world to transform data into intelligence. SAS gives you THE POWER TO KNOW®.

Editorial contacts:

Martin Zorn – Martin.Zorn@sas.com

Stas Melnikov – Stas.Melnikov@sas.com