October was another month for the history books. Equity markets notched new record highs: S&P 500 added $17 trillion since the April lows, Nvidia became the first $5T market cap company, Amazon surged almost 10% post earnings recording largest one-day market cap on record for this company. These are just a handful of stunning headlines we witnessed this month. At the same time, the Fed continued to cut rates, reducing the policy rate by 25bps to 3.75% – 4.00% range, despite inflation being firmly above the 2% target. Additionally, the end of QT was announced: starting on December 1, all treasury principal and MBS paydowns will be rolled into T-bills. This will shorten the Fed’s portfolio duration and ultimately shift some of the duration risk to the private sector. With no MBS reinvestments, MBS basis will likely widen. Elsewhere, ECB and BOJ held the rates steady with the latter signalling a possible December hike.

The exuberance in equities propagated into the credit markets – ICE BofA US Corporate OAS ended the month at 77bps – a 5th percentile of its historical distribution going back to 1996. A great illustration of the favorable credit market conditions was Meta’s $30B debt offering that drew a record high $125B in investor orders. The six tranches from 5 to 40yr in maturity were priced ranging from T+50bps on the short end to T+110bps on the long end of the spectrum. This underscores the market demand for the AI capex trade and appetite for duration and credit. On the other side of the spectrum, the collapse of First Brands triggered ~$1.5B in US loan ETF outflows – a reasonably mild response given the severity of the situation. The high yield spreads increased as well, briefly crossing the 300bps mark only to reverse the course and end the month at 285bps. Nevertheless, this does indicate some unease around the lower quality side of the credit market. There is some anecdotal evidence starting to emerge indicating shrinking lender appetite for lower quality credit and struggling sectors.

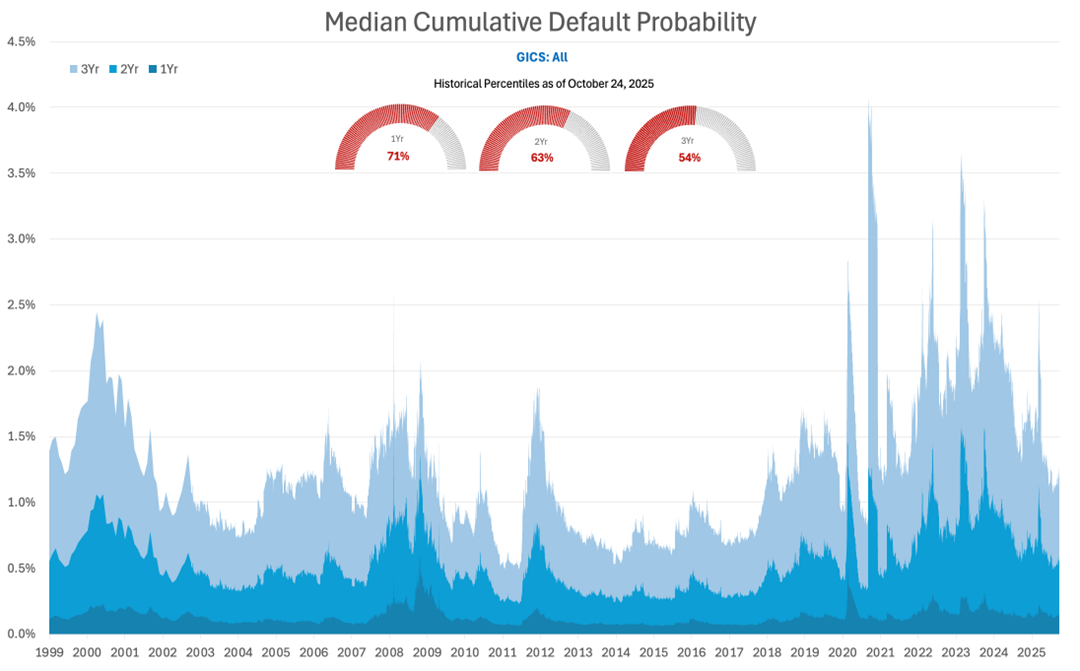

The SAS KRIS corporate credit models provide a more somber outlook. The median default probabilitiy across the top 3000 companies in the US by market cap is well above its historic median. In fact, the 1-year PD stands at 71st percentile for history going back to 1999 (Figure 1, Table 1). That divergence from buoyant prices reflects an expanding “great bifurcation”: winners are pulling away while a sizeable tail faces thin or negative FCF and higher funding costs. Liability-management exercises continue to tick up. The 1y vs 3y cumulative KDP comparison (71% vs 54% by historical percentile) also leans late-cycle, consistent with refinancing and near-term liquidity being the binding constraints rather than long-horizon solvency.

Figure 1: Median Cumulative Default Probability – Top 3000 Companies in the United States

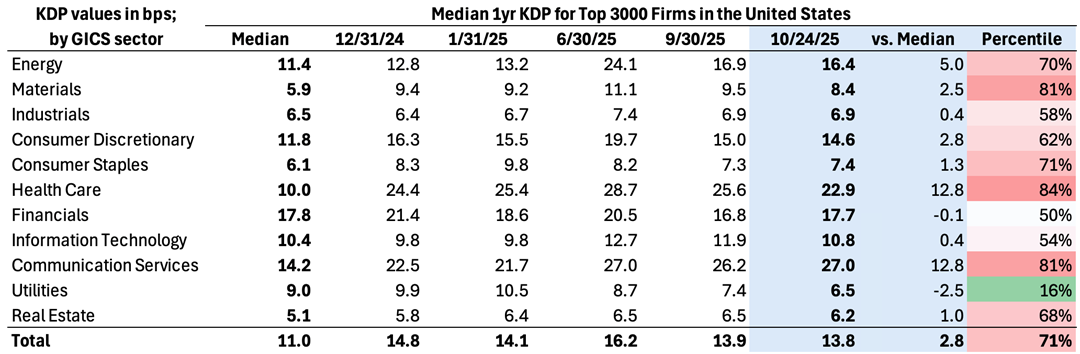

Sectors. Table 1 benchmarks each GICS sector against its long-run median using 1yr KDP measure. The Median column represents the median value of the daily median KDP going back to 1999. The columns that follow are historical snapshots of the median 1yr KDP and the last two columns are comparison of the most recent snapshot to historic median and its percentile.

Table 1: Median 1-year Default Probability (Top 3000 Firms in the United States)

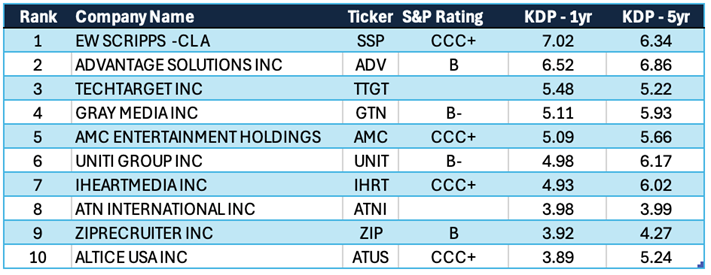

Relative to its historical range, the healthcare sector appeared to be in the worst shape. That is not surprising considering the impact of tariffs and policy uncertainty. Communication services was another challenged sector, where capital-intensive business drives high leverage and legacy media companies are being disrupted by cord cutting and sports/content inflation. Table 2 lists the ten highest-risk Comm Services names on 1y/5y KDP as of 10/10/25 – a mix of broadcast groups, ad-tech, cinema, and smaller telecom/fiber plays. By contrast, the digital-first winners – Netflix, Disney, Electronic Arts, Pinterest, among others – print single-digit bp KDPs.

Table 2: Communication Services – Top 10 Riskiest Companies (as of 10/10/25)

Why KDP matters now. Prices can stay buoyant while risk redistributes. KRIS default probabilities provide daily, issuer-level signals that make the bifurcation visible – pinpointing names where refinancing pressure, equity-vol shocks, or weakening coverage are rising even when spreads don’t budge. Used alongside market spreads and fundamentals, KDPs help identify issues not yet priced, providing actionable early warnings.

Contemporaneous Credit Conditions

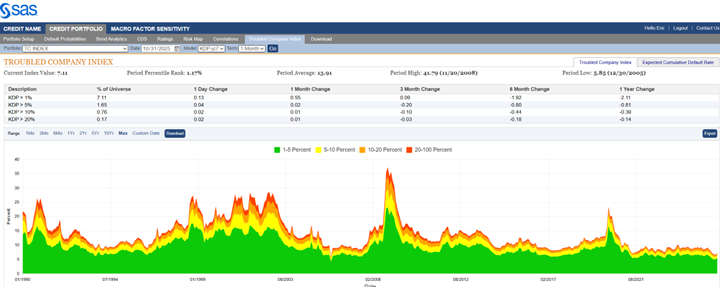

The Kamakura Troubled Company Index® closed the month of October at 7.11%, up 0.55% from the prior month. The index measures the percentage of 42,630 public firms worldwide with an annualized one-month default probability of over 1%. An increase in the index reflects declining credit quality, while a decrease reflects improving credit quality.

At the end of October, the percentage of companies with a default probability between 1% and 5% was 5.45%. The percentage with a default probability between 5% and 10% was 0.89%. Those with a default probability between 10% and 20% amounted to 0.59% of the total; and those with a default probability of over 20% amounted to 0.17%. For the month, the percentage of companies with a short term default probability over 1% ranged from a low of 6.43% on October 6 to a high of 7.09% on October 16.

Figure 2: Troubled Company Index®, October 31st, 2025

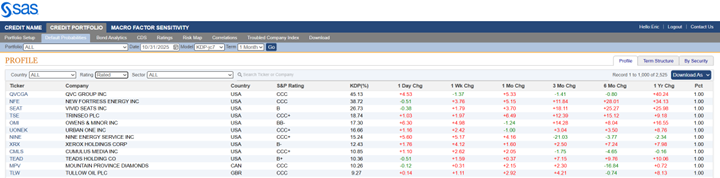

At the end of August, the riskiest 1% of rated public firms within the coverage universe as measured by 1-month default probability included ten companies in the U.S. , one in Canada and one in the UK. QVC Group, Inc (NASDAQ:QVCGA) remained the riskiest rated firm in our universe, with a 1-month KDP of 45.13%–up 5.33% over the past month.

Table 3: Riskiest Rated Companies Based on 1-month KDP, October 31st, 2025

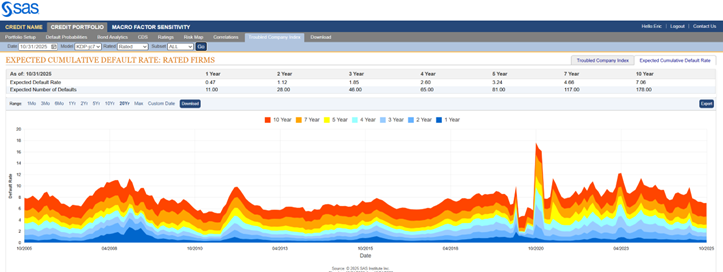

The Expected Cumulative Default Rate, the only daily index of credit quality of rated firms worldwide, shows the one-year rate of 0.47% up 0.02% from the prior month, with the 10-year rate up 0.02% at 7.06%.

Figure 3: Expected Cumulative Default Rates, October 31, 2025

About the Troubled Company Index

The Kamakura Troubled Company Index® measures the percentage of 42,500 public firms in 76 countries that have an annualized one-month default risk of over one percent. The average index value since January 1990 is 13.94%. Since July 2022, the index has used the annualized one-month default probability produced by the KRIS version 7.0 Jarrow-Chava reduced form default probability model, a formula that bases default predictions on a sophisticated combination of financial ratios, stock price history, and macro-economic factors.

The KRIS version 7.0 models were developed using a data base of more than 4 million observations and more than 4,000 corporate failures. A complete technical guide, including full model test results and key parameters, is provided to subscribers. Available models include the non-public-firm default model, the U.S. bank model, and the sovereign model.

The version 7.0 model was estimated over the period from 1990, through the Great Recession and ending in February 2022. The 76 countries currently covered by the index are Argentina, Australia, Austria, Bahrain, Bangladesh, Belgium, Belize, Botswana, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Ghana, Greece, Hungary, Hong Kong, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Jordan, Kenya, Kuwait, Luxembourg, Malaysia, Malta, Mauritius, Mexico, Nigeria, the Netherlands, New Zealand, Norway, Oman, Pakistan, Peru, the Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sri Lanka, Sweden, Switzerland, Tanzania, Taiwan, Thailand, Turkey, the United Arab Emirates, Uganda, the UK, the U.S., Vietnam and Zimbabwe.

About SAS

SAS is the leader in analytics. Through innovative software and services, SAS empowers and inspires customers around the world to transform data into intelligence. SAS gives you THE POWER TO KNOW®.

Editorial contacts:

- Stas Melnikov – Stas.Melnikov@sas.com

- Eric Penanhoat – Eric.Penanhoat@sas.com