NEW YORK, August 2, 2024: July has been quite a month. The Democrats selected a new candidate for president, former Federal Reserve President Bill Dudley called for immediate rate cuts amid recession concerns, and volatility spiked. After a brief sell-off, the market appears to be maintaining its risk-on posture, while at the same time executing a sector rotation which appears to be a shift from AI mania to value investing. The focus and momentum continue to be on bets related to rate cuts – when and how much. Since small caps were most at risk from high rates, the conventional wisdom is that they will benefit the most from a rate cut. But we need to look beyond rates alone and expect volatility to increase with economic uncertainty.

We were inspired by a July 21 Wall Street Journal article, “Americans are on Shakier Ground,” which accurately states, “The American economy has held up well against higher inflation and interest rates. Many individual borrowers haven’t.”

Let’s look at the key aspects of the U.S. economy and the markets:

- Employment has held up.

- Home values have held up or increased.

- Consumer spending has held up.

- The equity markets have risen, with bets on AI, technology, and interest rate cuts.

- The cost to borrow for a home, a car, or a credit card bill are the highest in decades.

- Inflation has cooled, but years of high inflation have escalated costs across the board.

- The yield curve, after a record period of inversion, is on the cusp of un-inverting.

While inflation is cooling, the cumulative effects of increased costs have resulted in a large decline in savings from the pandemic-era surge. Existing homes sales dropped 5.4% from a year ago, while the median home price hit a new record. Existing condo and co-op sales are down 14% from a year ago. Mortgage delinquencies are not problematic (yet), but based on HUD data, the reasons for new delinquencies are primarily a reduction in income and excessive obligations. The reasons for these new delinquencies are concerning. Auto repossessions are up 23% compared to last year–higher than in the pre-Covid period. These are all signs that American families are struggling, despite a strong stock market.

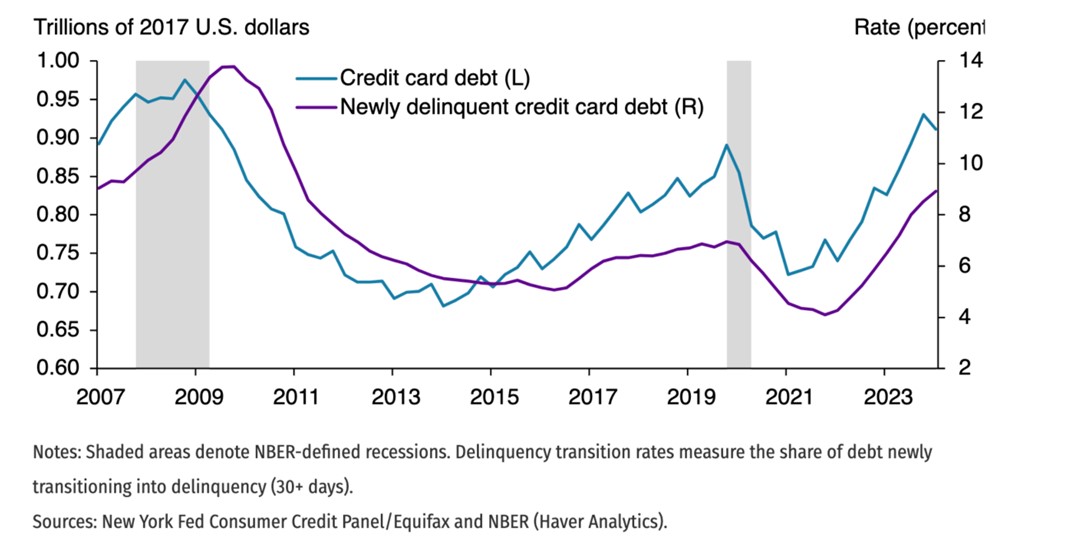

These signs are one reason that rates cuts are more likely to come sooner than later. One underappreciated impact of a rate cut is that it likely means the inverted yield curve will “un-invert.” What does the steepening of the yield curve mean? Perhaps after a record period of inversion, it could be a red flag for an economic slowdown – the opposite of what conventional wisdom would have us believe. The data above and Figure 1 below show that the consumer is tapped out, but perhaps a pullback in consumer spending has not yet shown up in corporate earnings. Certainly, this is not a positive sign for leveraged assets with short maturities as longer-term liquidity dries up.

Figure 1: Credit Card Debt and its Transition into Delinquency Have Increased Sharply over the Past Year

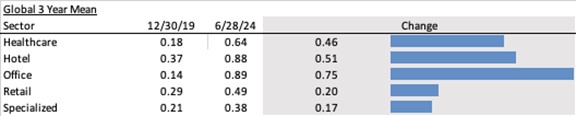

Office real estate is likely the asset class most at risk. We have already seen cracks in the single asset, single tenant market[1]. You could argue that this is the proverbial canary in the coal mine. Hybrid work is here to stay, resulting in weaker demand for office space, especially in “B” markets and older buildings. Higher operating costs from insurance and inflation, combined with downward pressure on rents, have a negative impact on Net Operating Income (NOI) With a steepening yield curve, lower NOI will be discounted by a higher rate, putting continued pressure on valuations at the same time more debt is scheduled for refinancing. Investors need to keep in mind which banks and insurance companies hold this paper. Table 1 shows building default pressure by sector. In addition to closely examining REITs and other real estate investments that could be adversely affected, investors should keep an eye open for possible opportunities to pick up promising investments at bargain prices.

Table 1: Change in Average KDP by REIT Property Class

Contemporaneous Credit Conditions

The Kamakura Troubled Company Index® closed the month at 8.60%, down 0.03% from the prior month. The index measures the percentage of 42,500 public firms worldwide with an annualized one-month default probability of over 1%. An increase in the index reflects declining credit quality, while a decrease reflects improving credit quality.

At the end of July, the percentage of companies with a default probability between 1% and 5% was 6.31%. The percentage with a default probability between 5% and 10% was 1.25%. Those with a default probability between 10% and 20% amounted to 0.77% of the total; and those with a default probability of over 20% amounted to 0.27%. For the month, short-term default probabilities ranged from a low of 8.36% on July 4 to a high of 8.98% on July 24. There were nine defaults in our coverage universe, with five in the United States and one each in Australia, China, Korea and the UK.

Figure 2: Troubled Company Index®, July 31, 2024

At the end of July, the riskiest 1% of rated public firms within the coverage universe included 12 companies in the U.S. and one each in Canada and France. The riskiest firm was the Container Store Group (NYSE:TCS), with a one-month KDP of 53.26%, up 28.23% for the month. TCS suspended financial guidance after its quarterly report after announcing that it is examining strategic alternatives.

Table 2: Riskiest Rated Companies Based on 1-Month KDP, July 31, 2024

The Kamakura Expected Cumulative Default Rate, the only daily index of credit quality of rated firms worldwide, shows the one-year rate of 0.55% down .02%, with the 10-year rate down 0.13% at 9.16%.

Figure 3: Expected Cumulative Default Rates, July 31, 2024

About the Troubled Company Index

The Kamakura Troubled Company Index® measures the percentage of 42,500 public firms in 76 countries that have an annualized one-month default risk of over one percent. The average index value since January 1990 is 14.11%. Since July 2022, the Kamakura index has used the annualized one-month default probability produced by the KRIS version 7.0 Jarrow-Chava reduced form default probability model, a formula that bases default predictions on a sophisticated combination of financial ratios, stock price history, and macro-economic factors.

The KRIS version 7.0 models were developed using a data base of more than 4 million observations and more than 4,000 corporate failures. A complete technical guide, including full model test results and key parameters, is provided to subscribers. Available models include the non-public-firm default model, the U.S. bank model, and the sovereign model.

The version 7.0 model was estimated over the period from 1990, through the Great Recession and ending in February 2022. The 76 countries currently covered by the index are Argentina, Australia, Austria, Bahrain, Bangladesh, Belgium, Belize, Botswana, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Ghana, Greece, Hungary, Hong Kong, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Jordan, Kenya, Kuwait, Luxembourg, Malaysia, Malta, Mauritius, Mexico, Nigeria, the Netherlands, New Zealand, Norway, Oman, Pakistan, Peru, the Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sri Lanka, Sweden, Switzerland, Tanzania, Taiwan, Thailand, Turkey, the United Arab Emirates, Uganda, the UK, the U.S., Vietnam and Zimbabwe.

About SAS

SAS is the leader in analytics. Through innovative software and services, SAS empowers and inspires customers around the world to transform data into intelligence. SAS gives you THE POWER TO KNOW®.

Editorial contacts:

- Martin Zorn – Martin.Zorn@sas.com

- Stas Melnikov – Stas.Melnikov@sas.com

[1] https://www.wsj.com/livecoverage/stock-market-today-dow-sp500-nasdaq-live-earnings-07-17-2024/card/how-a-corner-of-the-bond-market-once-seen-as-ultrasafe-came-unstuck-vLIFzCmrjqqnljX6rKeI