Donald R. van Deventer July 8, 2025 Abstract The size of the term premium embedded in the current U.S. Treasury yield curve has...

CONNECT ME

SAS Weekly Treasury Simulation, July 3, 2025: Most Likely Level for 3-Month Bill Rate in Ten Years Steady at the 1% to 2% Range

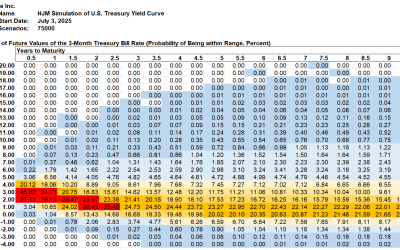

Summary The most likely range for 3-month bill yields is the 1% to 2% range, unchanged from last week. The probability of being...

SAS Weekly Treasury Simulation, June 27, 2025: Most Likely Level for 3-Month Bill Rate in Ten Years Up One Percent to 1% to 2% Range

Summary The most likely range for 3-month bill yields is the 1% to 2% range, up one percent from last week from last week. The...

SAS Weekly Treasury Simulation, June 20, 2025: Peak in One-Month Forward Rates Up 0.14% to 6.16%

Summary The most likely range for 3-month bill yields is the 0% to 1% range, unchanged from last week. Treasury 2-year yields...

SAS Weekly Treasury Simulation, June 13, 2025: Most Likely Range for Three-Month Bill Rate in 10 Years Drops One Percent

Summary The most likely range for 3-month bill yields is the 0% to 1% range, down from the 1% to 2% range last week. Treasury...

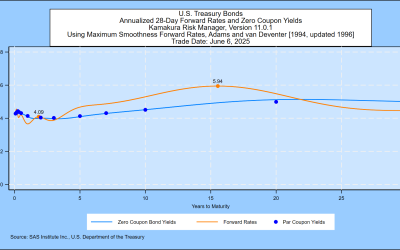

SAS Weekly Treasury Simulation, June 6, 2025: Peak in One-Month Forward Rates Drops 0.29%

Summary The most likely range for 3-month bill yields is again the 1% to 2% range, now 45 basis points more likely than the 0%...

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, May 30, 2025

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the...

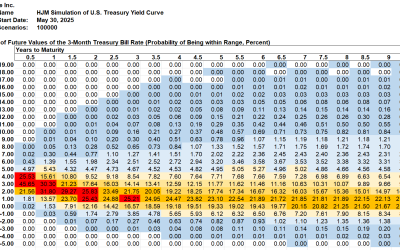

SAS Weekly Treasury Simulation, May 30, 2025: Most Likely Range for 10-Year Yield in 2035 Is 2% to 3%

Summary The most likely range for 3-month bill yields is again the 1% to 2% range, just 22 basis points more likely than the 0%...

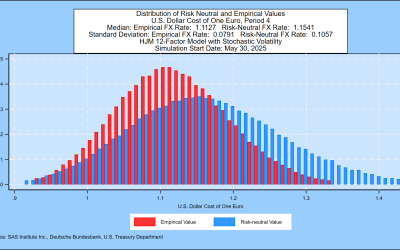

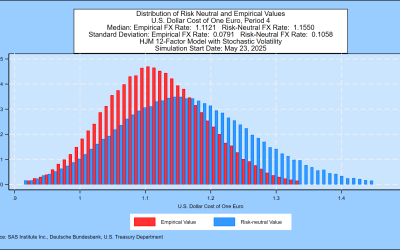

SAS Weekly Bund Yield and Euro Simulation, May 23, 2025: Median Scenario for the Euro at 1.1121 One Year Forward

Summary The 2-year/10-year Bund spread closed the week at a positive 0.802%, a change from 0.7385% last week. As a result,...

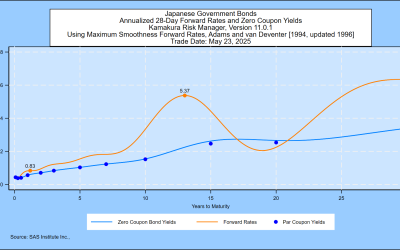

SAS Weekly Japanese Government Bond and Yen Simulation, May 23, 2025: One-month Forward Bill Rate Jumps 1.61% to 6.35% at 30 Years

Summary The median level for the yen-U.S. dollar exchange rate is 148.09 one year from now, compared to 151.10 last week,...

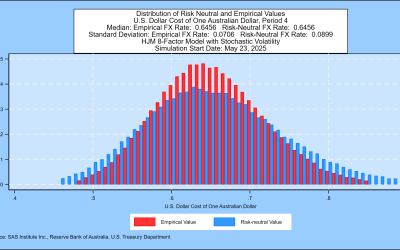

SAS Weekly Australian Dollar and Government Bond Yield Simulation, May 23, 2025: Median FX Rate Scenario 0.6456 One Year Forward

Summary One-month forward Australian Government Bond rates peaked at 5.40% this week, compared to 5.48% the previous week. The...

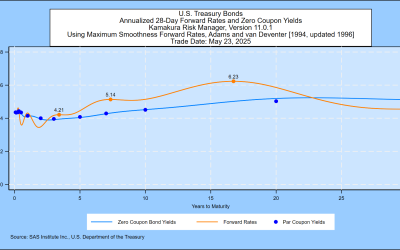

SAS Weekly Treasury Simulation, May 23, 2025: One-month Forward Rate Peak Up 0.18% to 6.23%

Summary The most likely range for 3-month bill yields is again the 1% to 2% range, just 20 basis points more likely than the 0%...