Summary The most likely range for 3-month bill yields is the 1% to 2% range, unchanged from last week. The probability of being...

CONNECT ME

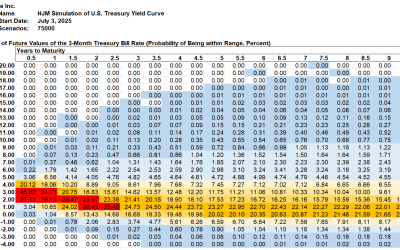

SAS Weekly Treasury Simulation, June 27, 2025: Most Likely Level for 3-Month Bill Rate in Ten Years Up One Percent to 1% to 2% Range

Summary The most likely range for 3-month bill yields is the 1% to 2% range, up one percent from last week from last week. The...

SAS Weekly Treasury Simulation, June 20, 2025: Peak in One-Month Forward Rates Up 0.14% to 6.16%

Summary The most likely range for 3-month bill yields is the 0% to 1% range, unchanged from last week. Treasury 2-year yields...

SAS Weekly Treasury Simulation, June 13, 2025: Most Likely Range for Three-Month Bill Rate in 10 Years Drops One Percent

Summary The most likely range for 3-month bill yields is the 0% to 1% range, down from the 1% to 2% range last week. Treasury...

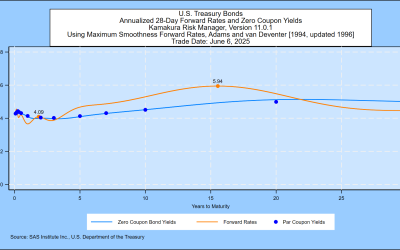

SAS Weekly Treasury Simulation, June 6, 2025: Peak in One-Month Forward Rates Drops 0.29%

Summary The most likely range for 3-month bill yields is again the 1% to 2% range, now 45 basis points more likely than the 0%...

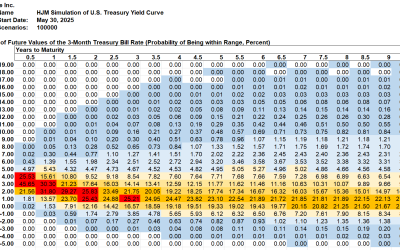

SAS Weekly Treasury Simulation, May 30, 2025: Most Likely Range for 10-Year Yield in 2035 Is 2% to 3%

Summary The most likely range for 3-month bill yields is again the 1% to 2% range, just 22 basis points more likely than the 0%...

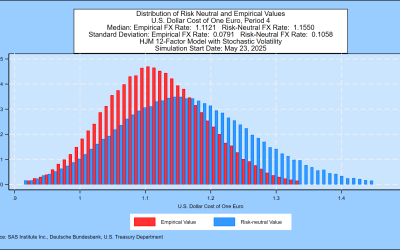

SAS Weekly Bund Yield and Euro Simulation, May 23, 2025: Median Scenario for the Euro at 1.1121 One Year Forward

Summary The 2-year/10-year Bund spread closed the week at a positive 0.802%, a change from 0.7385% last week. As a result,...

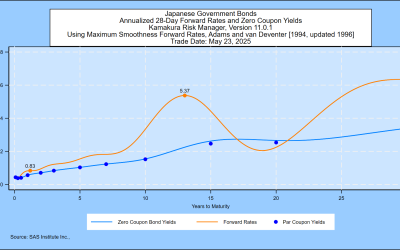

SAS Weekly Japanese Government Bond and Yen Simulation, May 23, 2025: One-month Forward Bill Rate Jumps 1.61% to 6.35% at 30 Years

Summary The median level for the yen-U.S. dollar exchange rate is 148.09 one year from now, compared to 151.10 last week,...

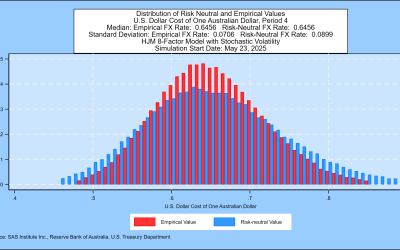

SAS Weekly Australian Dollar and Government Bond Yield Simulation, May 23, 2025: Median FX Rate Scenario 0.6456 One Year Forward

Summary One-month forward Australian Government Bond rates peaked at 5.40% this week, compared to 5.48% the previous week. The...

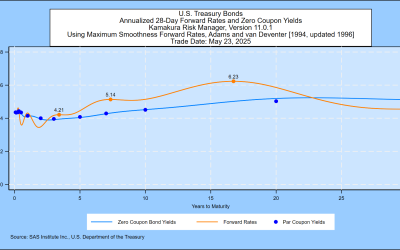

SAS Weekly Treasury Simulation, May 23, 2025: One-month Forward Rate Peak Up 0.18% to 6.23%

Summary The most likely range for 3-month bill yields is again the 1% to 2% range, just 20 basis points more likely than the 0%...

SAS Weekly Swedish Krona and Government Bond Yield Simulation, May 16, 2025: Median Scenario One Year Forward for the Swedish Krona is 10.34

Summary One-month forward Swedish Government Bond rates peaked at 2.75% this week, compared to 2.73% the previous week. The...

SAS Weekly Bund Yield and Euro Simulation, May 16, 2025: Median Scenario for the Euro at 1.0958 One Year Forward

Summary The 2-year/10-year Bund spread closed the week at a positive 0.7385%, a change from 0.769% last week. As a result,...