The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the...

CONNECT ME

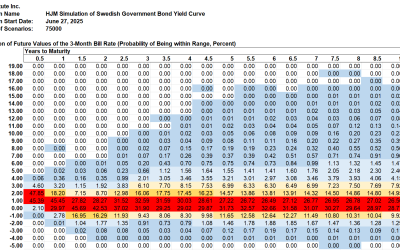

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, June 27, 2025

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the...

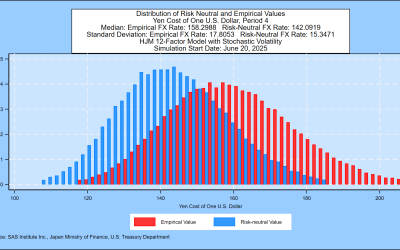

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, June 20, 2025

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the...

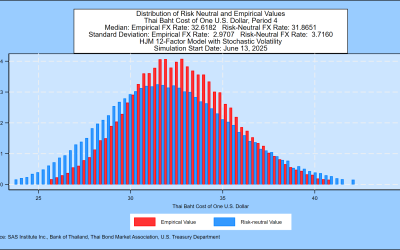

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, June 13, 2025

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the...

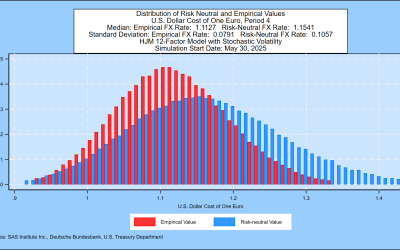

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, May 30, 2025

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the...

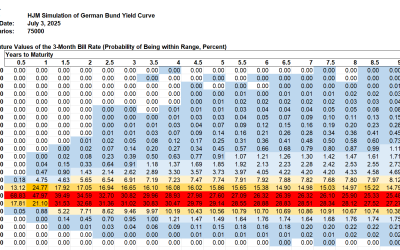

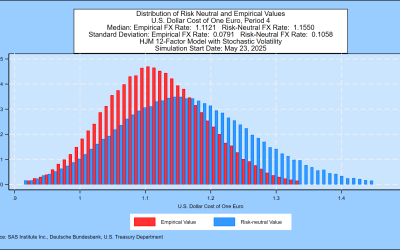

SAS Weekly Bund Yield and Euro Simulation, May 23, 2025: Median Scenario for the Euro at 1.1121 One Year Forward

Summary The 2-year/10-year Bund spread closed the week at a positive 0.802%, a change from 0.7385% last week. As a result,...

SAS Weekly Bund Yield and Euro Simulation, May 16, 2025: Median Scenario for the Euro at 1.0958 One Year Forward

Summary The 2-year/10-year Bund spread closed the week at a positive 0.7385%, a change from 0.769% last week. As a result,...

SAS Weekly Bund Yield and Euro Simulation, May 9, 2025: Median Scenario for the Euro at 1.1082Fe One Year Forward

Summary The 2-year/10-year Bund spread closed the week at a positive 0.769%. As a result, today’s simulation shows that the...

SAS Weekly Bund Yield and Euro Simulation, April 25, 2025: Median Scenario for the Euro at 1.1185 One Year Forward

Summary The 2-year/10-year Bund spread closed the week at a positive 0.7465%, a change from 0.786% last week. As a result,...

SAS Weekly Bund Yield and Euro Simulation, April 17, 2025: Median Scenario for the Euro at 1.1190 One Year Forward

Summary The 2-year/10-year Bund spread closed the week at a positive 0.786%, a change from 0.778% last week. As a result,...

SAS Weekly Bund Yield and Euro Simulation, April 11, 2025: Median Scenario for the Euro at 1.1159 One Year Forward

Summary The 2-year/10-year Bund spread closed the week at a positive 0.778%, a change from 0.743% last week. As a result,...

SAS Weekly Bund Yield and Euro Simulation, April 4, 2025: Median Scenario for the Euro at 1.0918 One Year Forward

Summary The 2-year/10-year Bund spread closed the week at a positive 0.743%, a change from 0.713% last week. As a result,...