Reduced Form vs. Merton Default Risk

NEW YORK, April 3, 2020: Back in 2012, Dr. Donald van Deventer proclaimed in a blog post: The Debate about Reduced Form Credit Models Versus the Merton Model is Over. Yet today many market practitioners continue to use the Merton model—or some form of it–for pricing, as well as for calculating default risk. Today we will do a quick comparison of how the two models are performing in these extraordinary times. We will also provide a snapshot of the latest market risks.

The Kamakura Troubled Company Index continues to show an increase in default risk, which rose 0.47% to 32.40%, resulting in a drop in credit quality to the 3rd percentile.

Troubled Company Index – April 2, 2020

Using one- month default probabilities consistent with the Troubled Company Index, we look at the ten riskiest firms using both the Kamakura Jarrow-Chava (JC6) reduced form model and the

Merton Structural (MS6) model. In both cases we see two different lists for rated firms. Further, we see that the default probabilities for the JC6 firms are about three times higher than those of the firms on the Merton list.

Ten Riskiest Rated Firms – 1-Month KDP JC-6

Ten Riskiest Firms – 1-Month Default Probability Merton Structural Model

This leads to the question of which model to use. (Of course, some organizations use multiple models—which is fine, as long as you clearly understand the drivers behind them.) Do these two models diverge in all cases? The answer is no, as you can see from the comparison of default models for ExxonMobil below.

1-Month KDP ExxonMobil

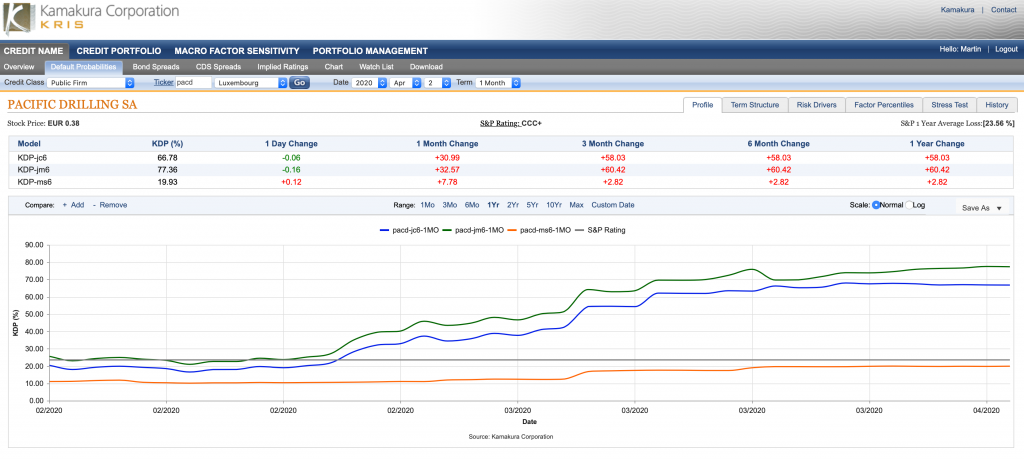

More illustrative are a multi-model comparisons of the riskiest firms based on both measures. In the case of Chaparral Energy, we see that the JC risk is 3.5 times the Merton risk. In the case of Pacific Drilling, the JC risk is over 3.3 times greater.

1-month KDP Chaparral Energy Inc

1-month KDP Pacific Drilling

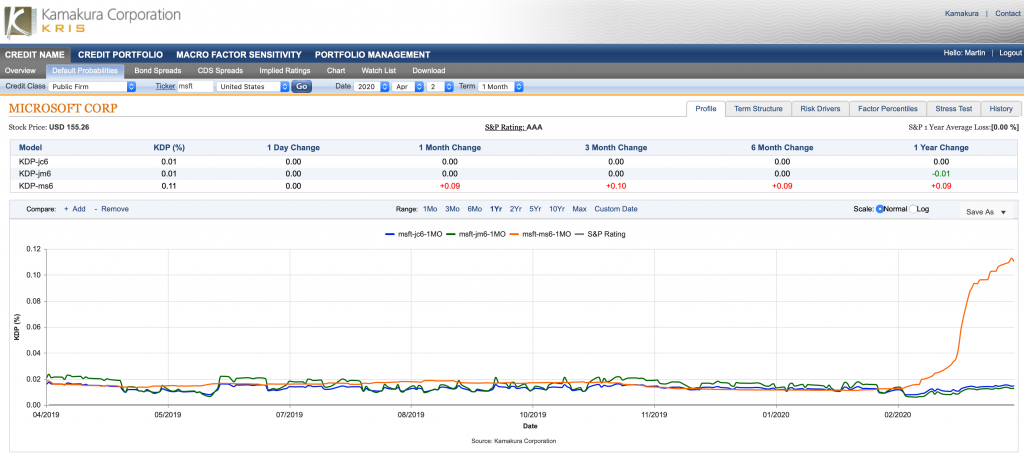

On the other hand, a look at strong companies shows the opposite, with Merton default probabilities higher than the JC default levels. These results clearly show the benefits of additional factors that influence the reduced form results, compared to a structural model that is more influenced by stock price.

1-month KDP Microsoft

1-month KDP Apple

1-month KDP Walt Disney Company

We close this weekly report with the updated Expected Cumulative Default Rate, in which the one-year probability increased 0.24% to 4.33% and 10-year rose 0.31% to 22.46% since month-end.

Expected Cumulative Default Rate

About Kamakura Corporation

Founded in 1990, Honolulu-based Kamakura Corporation is a leading provider of risk management information, processing, and software. Kamakura was recognized as a category leader in the Chartis Report, Technology Solutions for Credit Risk 2.0 2018. Kamakura was named to the World Finance 100 by the editor and readers of World Finance magazine in 2017, 2016 and 2012. In 2010, Kamakura was the only vendor to win two Credit Magazine innovation awards. Kamakura Risk Manager, first sold commercially in 1993 and now in version 10.0.5, is the first enterprise risk management system for users focused on credit risk, asset and liability management, market risk, stress testing, liquidity risk, counterparty credit risk, and capital allocation from a single software solution. The KRIS public firm default service was launched in 2002. The KRIS sovereign default service, the world’s first, was launched in 2008, and the KRIS nonpublic firm default service was offered beginning in 2011. Kamakura added its U.S. Bank default probability service in 2014.

Kamakura has served more than 330 clients with assets ranging in size from $1.5 billion to $3.0 trillion. Current clients have a combined “total assets” or “assets under management” in excess of $26 trillion. Its risk management products are currently used in 47 countries, including the United States, Canada, Germany, the Netherlands, France, Austria, Switzerland, the United Kingdom, Russia, Ukraine, South Africa, Australia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, Singapore, Sri Lanka, Taiwan, Thailand, Vietnam, and many other countries in Asia, Europe and the Middle East.

To follow risk commentary by Kamakura on a daily basis, please follow:

Kamakura CEO Dr. Donald van Deventer (www.twitter.com/dvandeventer)

Kamakura President Martin Zorn (www.twitter.com/riskmgrhi)

Kamakura’s official twitter account (www.twitter.com/KamakuraCo).

For more information, please contact:

Kamakura Corporation

2222 Kalakaua Avenue, Suite 1400, Honolulu, Hawaii 96815

Telephone: 1-808-791-9888

Facsimile: 1-808-791-9898

Information: info@kamakuraco.com

Web site: www.kamakuraco.com