Extraordinary Times – Extraordinary Actions

Monetary Actions and Market Impact

NEW YORK, March 30, 2020: The disruption and dislocation across industries and markets from the coronavirus (COVID-19) pandemic continued through the week. Here’s a summary of some of the most important considerations:

- Many economists assume that the actions governments and central banks are taking will lead to a global recession.

- Given the volatility and rapid movement in spreads, determining market valuation and capital adequacy for quarterly reporting will be challenging.

- There is much discussion about the impact of central bank actions on risk-free rates.

Last month Federal Reserve Vice Chair Richard Clarida gave a presentation at the U.S. Monetary Policy Forum entitled “Financial Markets and Monetary Policy – Is There a Hall of Mirrors Problem?” Former Chair Benjamin Bernanke referred to the ‘hall of mirrors” problem as a situation in which central bank reactions and financial market prices interact in economically suboptimal and potentially destabilizing ways. Does this concept apply to the recent actions taken by U.S. and Canadian central banks?

On March 27, the Bank of Canada (Banque du Canada) held a press conference announcing its decision to lower the target for the overnight rate by 50 basis points to ¼ percent. This was an unscheduled rate decision that brought the rate to its effective lower bound.

Could we see negative rates in North America? How do we incorporate these actions into our models for future rates, and what impact are they having on the government bond markets?

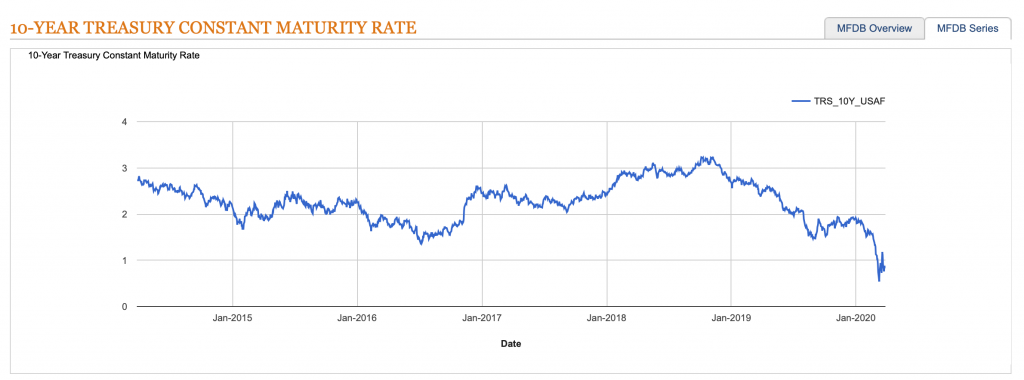

As you can see from the next four charts, we have seen dramatic reductions in yields across the curve.

Figure 1: 2-Year Government Bond Yield – Canada

Figure 2: 10-Year Government Bond Yield – Canada

Figure 3: 2-Year U.S Treasury Constant Maturity Rate

Figure 4: 10-Year U.S Treasury Constant Maturity Rate

The movement in short term rates has been even more dramatic:

Figure 5: 1-Month U.S Constant Maturity Rate

Figure 6: KRIS Sovereign Risk United States

Figure 7: KRIS Sovereign Risk Canada

One of the questions we need to ask is whether we foresee negative rates. When we look at future T-bill distribution rates in Figure 8 below, we see that negative rates are indeed possible—even likely. The chart shows the distribution based on 200,000 scenarios using a 10-factor HJM model with daily data from 1962-2019 using stochastic volatility projected from March 20, 2020. In fact, on March 25, 2020, the Treasury Department reported zero interest rates for one to three months; on March 26, it reported a zero-interest rate for the three month yield. The number of factors required for each government yield curve has been thoroughly researched and is available from Kamakura.

Figure 8: Distribution of Empirical and Risk Neutral 3-month T-bill Rates – 1 Year Forward

We have seen extraordinary actions by governments and central banks reacting in realtime to rapidly changing conditions on a day-to-day basis. Testing market values or calculating mark-to-model for instruments this quarter will require a different approach by market participants. Kamakura has detailed data for global rates, spreads and models, which are available to our clients on a subscription basis.

About Kamakura Corporation

Founded in 1990, Honolulu-based Kamakura Corporation is a leading provider of risk management information, processing, and software. Kamakura was recognized as a category leader in the Chartis Report, Technology Solutions for Credit Risk 2.0 2018. Kamakura was named to the World Finance 100 by the editor and readers of World Finance magazine in 2017, 2016 and 2012. In 2010, Kamakura was the only vendor to win two Credit Magazine innovation awards. Kamakura Risk Manager, first sold commercially in 1993 and now in version 10.0.5, is the first enterprise risk management system for users focused on credit risk, asset and liability management, market risk, stress testing, liquidity risk, counterparty credit risk, and capital allocation from a single software solution. The KRIS public firm default service was launched in 2002. The KRIS sovereign default service, the world’s first, was launched in 2008, and the KRIS nonpublic firm default service was offered beginning in 2011. Kamakura added its U.S. Bank default probability service in 2014.

Kamakura has served more than 330 clients with assets ranging in size from $1.5 billion to $3.0 trillion. Current clients have a combined “total assets” or “assets under management” in excess of $26 trillion. Its risk management products are currently used in 47 countries, including the United States, Canada, Germany, the Netherlands, France, Austria, Switzerland, the United Kingdom, Russia, Ukraine, South Africa, Australia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, Singapore, Sri Lanka, Taiwan, Thailand, Vietnam, and many other countries in Asia, Europe and the Middle East.

To follow risk commentary by Kamakura on a daily basis, please follow:

Kamakura CEO Dr. Donald van Deventer (www.twitter.com/dvandeventer)

Kamakura President Martin Zorn (www.twitter.com/riskmgrhi)

Kamakura’s official twitter account (www.twitter.com/KamakuraCo).

For more information, please contact:

Kamakura Corporation

2222 Kalakaua Avenue, Suite 1400, Honolulu, Hawaii 96815

Telephone: 1-808-791-9888

Facsimile: 1-808-791-9898

Information: info@kamakuraco.com

Web site: www.kamakuraco.com