Corporate Default Risk Continues to Improve

Kamakura Troubled Company Index Declines by 0.32% to 10.46%

NEW YORK, May 2, 2019: The Kamakura Troubled Company Index® ended April at 10.46%, a decrease of 0.32% from the end of March. The index reflects the percentage of 39,000 public firms that have a default probability of over 1%. An increase in the index reflects declining credit quality, while a decrease reflects improving credit quality.

At the close of April, the percentage of companies with a default probability between 1% and 5% was 8.55%—a decrease of 0.21% from the end of March. The percentage with a default probability between 5% and 10% was 1.31%, a decrease of 0.03%. Those with a default probability between 10% and 20% amounted to 0.47% of the total, down 0.05%, and those with a default probability of over 20% amounted to 0.13%, down 0.03% from a month earlier.

The index continued its year-to-date improvement while volatility declined during the month, with the index ranging from 11.04% on April 4 to 10.11% on April 22.

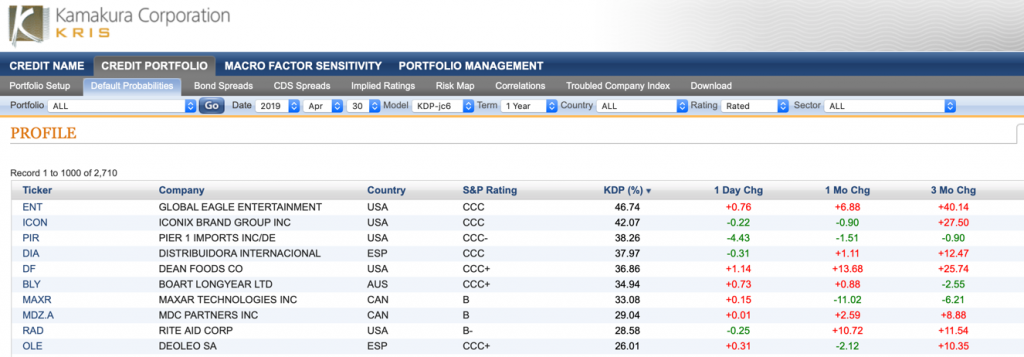

At 10.46%, the troubled company index now sits at the 56th percentile of historical credit quality as measured since 1990. Among the 10 riskiest-rated firms listed in April, five are in the U.S., with two each in Canada and Spain and one in Australia. Debenhams PLC (DEB:LN), formerly the riskiest-rated company in our universe, announced a financial restructuring through which the firm’s creditors took control of the business and assets. Global Eagle Entertainment Inc. (ENT:NASDAQ) became the new riskiest-rated firm, with a one-year of KDP of 46.74%. During the month there were 13 defaults in our coverage universe, with 7 in the US, 4 in Australia and one each in Canada and Great Britain.

The Kamakura expected cumulative default curve for all rated companies worldwide showed decreases at both the short and the long end, with the one-year expected default rate decreasing by 0.06% to 1.11% and the 10-year rate decreasing by 0.28% to 13.58%.

Commentary

By Martin Zorn, President and Chief Operating Officer, Kamakura Corporation

Improvement in the Kamakura Troubled Company Index® reflects continued strong market conditions and positive financial results. However, the Expected Cumulative Default Rate is showing signs that the default rate will be increasing as we look across the term structure. We can analyze the Expected Cumulative Default Rates in much the same way we derive forward rates from a Treasury curve.

We have analyzed the evolution of the longer-term segment of the curve and found that the telecommunications and consumer discretionary segments are disproportionately responsible for driving up expected defaults over the next several years. From a market perspective, retailing has been particularly weak. A recent report from Coresight Research indicated that U.S. retailers have announced 5,994 store closings, already exceeding last year’s total.

Another interesting insight is that expected European defaults have risen relative to other global markets, with Italy having the highest expected default rate. Recent economic data shows that the number of European countries with negative rates has been increasing, with negative two-year yields in Spain, Belgium, France, Germany, the Netherlands, Portugal and Sweden. With Italy in recession and German growth slowing, we see very different policy reactions. German officials have pledged to maintain a budget surplus rather than engage in stimulative spending, contributing to an unusually wide spread between U.S. and German Rates. Italian officials, on the other hand, have promised more borrowing–even in light of existing high debt levels–to try to kick-start their economy.

As we have noted for the past several months, the short-term outlook for credit is benign for now with warning signs as we look out further. The good news is that this provides an opportunity for portfolio managers to de-risk portfolios, as the markets are looking for yield and not yet worried about risk.

About the Troubled Company Index

The Kamakura troubled company index (Reg. U.S. Pat) measures the percentage of 39,000 public firms in 76 countries that have an annualized one-month default risk of over one percent. The average index value since January, 1990 is 14.38%. Since November, 2015, the Kamakura index has used the annualized one-month default probability produced by the KRIS version 6.0 Jarrow-Chava reduced form default probability model, a formula that bases default predictions on a sophisticated combination of financial ratios, stock price history, and macro-economic factors.

The KRIS version 6.0 models were developed using a data base of more than 2.2 million observations and more than 2,600 corporate failures. A complete technical guide, including full model test results and parameters, is provided to subscribers. The KRIS service also includes a wide array of other default probability models that can be seamlessly loaded into Kamakura’s state-of-the-art enterprise risk management software engine, the Kamakura Risk Manager. Available models include the non-public-firm default model, the commercial real estate model, the U.S. bank model, and the sovereign model. Related data includes credit default swap trading volume by reference name, market implied credit spreads, and prices on all traded corporate bonds traded in the U.S. market. Macro factor parameter subscriptions include Heath, Jarrow, and Morton term structure models for government securities in the U.S., Germany, the UK, Canada, Spain, Sweden, Australia, Japan, Thailand, and Singapore. All parameters are derived in a no-arbitrage manner consistent with seminal papers by Heath, Jarrow, and Morton, as well as Amin and Jarrow. A KRIS Macro Factor Scenario Service subscription includes both risk-neutral and “real world” empirical scenarios for interest rates and macro factors.

The version 6.0 model was estimated over the period from 1990 to May 2014 and includes the insights of the entirety of the recent credit crisis. The 76 countries currently covered by the index are: Argentina, Australia, Austria, Bahrain, Bangladesh, Belgium, Belize, Botswana, Brazil, Bulgaria, Canada, Chile, China, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Egypt, Estonia, Finland, France, Germany, Ghana, Greece, Hungary, Hong Kong, Iceland, India, Indonesia, Ireland, Israel, Italy, Japan, Jordan, Kenya, Kuwait, Luxembourg, Malaysia, Malta, Mauritius, Mexico, Nigeria, the Netherlands, New Zealand, Norway, Oman, Pakistan, Peru, the Philippines, Poland, Portugal, Qatar, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sri Lanka, Sweden, Switzerland, Tanzania, Taiwan, Thailand, Turkey, the United Arab Emirates, Uganda, the UK, the U.S., Vietnam and Zimbabwe.

About Kamakura Corporation

Founded in 1990, Honolulu-based Kamakura Corporation is a leading provider of risk management information, processing, and software. Kamakura was recognized as a category leader in the Chartis Report,Technology Solutions for Credit Risk 2.0 2018. Kamakura was named to the World Finance 100 by the editor and readers of World Finance magazine in 2017, 2016 and 2012. In 2010, Kamakura was the only vendor to win two Credit Magazine innovation awards. ,Kamakura Risk Manager, first sold commercially in 1993 and now in version 10.0.3, is the first enterprise risk management system for users focused on credit risk, asset and liability management, market risk, stress testing, liquidity risk, counterparty credit risk, and capital allocation from a single software solution. The ,KRIS public firm default service was launched in 2002. The,KRIS sovereign default service, the world’s first, was launched in 2008, and the ,KRIS non-public firm default service was offered beginning in 2011. Kamakura added its ,U.S. Bank default probability service in 2014.

Kamakura has served more than 330 clients with assets ranging in size from $1.5 billion to $3.0 trillion. Its risk management products are currently used in 47 countries, including the United States, Canada, Germany, the Netherlands, France, Austria, Switzerland, the United Kingdom, Russia, Ukraine, South Africa, Australia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, Singapore, Sri Lanka, Taiwan, Thailand, Vietnam, and many other countries in Asia, Europe and the Middle East.

To follow risk commentary by Kamakura on a daily basis, please follow:

Kamakura CEO Dr. Donald van Deventer (www.twitter.com/dvandeventer)

Kamakura President Martin Zorn (www.twitter.com/riskmgrhi) and

Kamakura’s official twitter account (www.twitter.com/KamakuraCo).

For more information, please contact:

Kamakura Corporation

2222 Kalakaua Avenue, Suite 1400, Honolulu, Hawaii 96815

Telephone: 1-808-791-9888

Facsimile: 1-808-791-9898

Information: info@kamakuraco.com

Web site: www.kamakuraco.com