Research

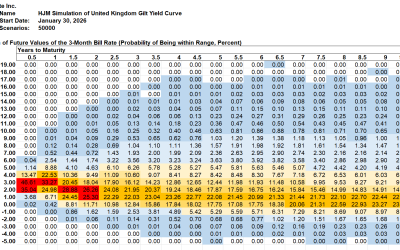

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, January 30, 2026

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the...

Divergence in Credit Conditions: Index-Level Resilience vs Typical-Firm Strain

Markets opened 2026 with risk appetite intact, and early performance patterns suggested leadership may be broadening beyond the...

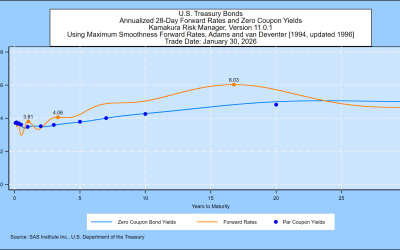

SAS Weekly Treasury Simulation, January 30, 2026: Long-term Peak in 1-Month Forward Rates Up 0.12% to 6.03%

Summary The most likely range for 3-month bill yields in 10 years remained at the 1% to 2% range this week. The probability of...

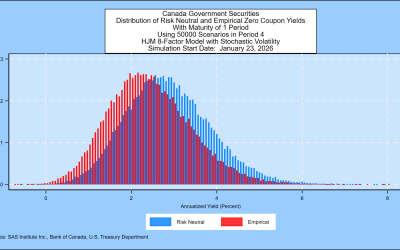

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, January 23, 2026

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the...

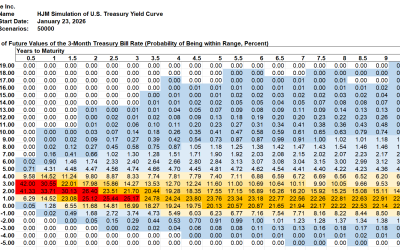

SAS Weekly Treasury Simulation, January 23, 2026: Most Likely 3-Month Bill Rate Shows Steady Decline

Summary The most likely range for 3-month bill yields in 10 years remained at the 1% to 2% range this week. The probability of...

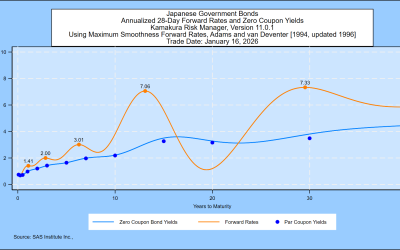

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, January 16, 2026

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the...

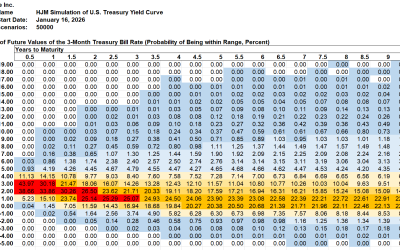

SAS Weekly Treasury Simulation, January 16, 2026: Most Likely Range for 3-Month T-Bill Rate 10 Years Forward Unchanged at 1% to 2%

Summary The most likely range for 3-month bill yields in 10 years remained at the 1% to 2% range this week. The probability of...

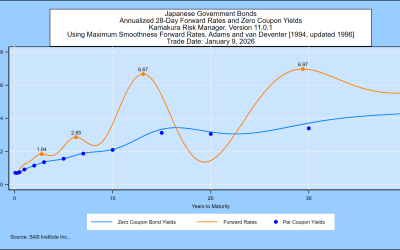

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, January 9, 2026

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the...

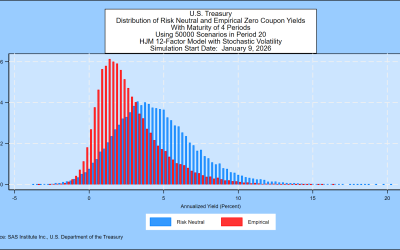

SAS Weekly Treasury Simulation, January 9, 2026: 50,000 No-Arbitrage Heath Jarrow and Morton Yield Scenarios

Summary The most likely range for 3-month bill yields in 10 years remained at the 1% to 2% range this week. The probability of...

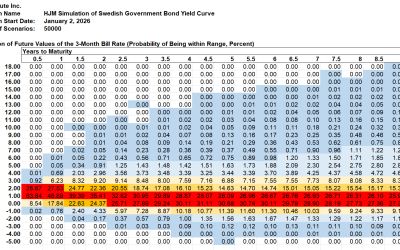

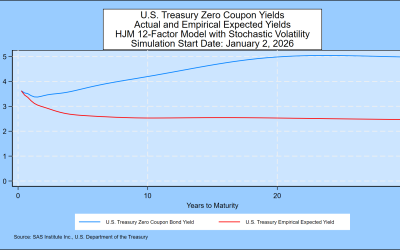

HJM++© Correlated Government Yield and Foreign Exchange Rate Simulations for Asia-Pacific, Europe and North America, January 2, 2026

The Heath, Jarrow and Morton [1992] framework for simulation and valuation using risk-free interest rates has been called “the...

SAS Weekly Treasury Simulation, January 2, 2026: Measuring the Term Premium in U.S. Treasuries

Summary The most likely range for 3-month bill yields in 10 years remained at the 1% to 2% range this week. The probability of...

The Narrowing Definition of “Winner”

December capped a year in which headline growth and risk-on positioning coexisted with rising under-the-surface strain—a...