Donald R. van Deventer[1]

First Version: February 22, 2022

This Version: February 23, 2022

ABSTRACT

Please note: Kamakura Corporation term structure models are updated monthly. For the most recent set of coefficients, contact info@kamakuraco.com

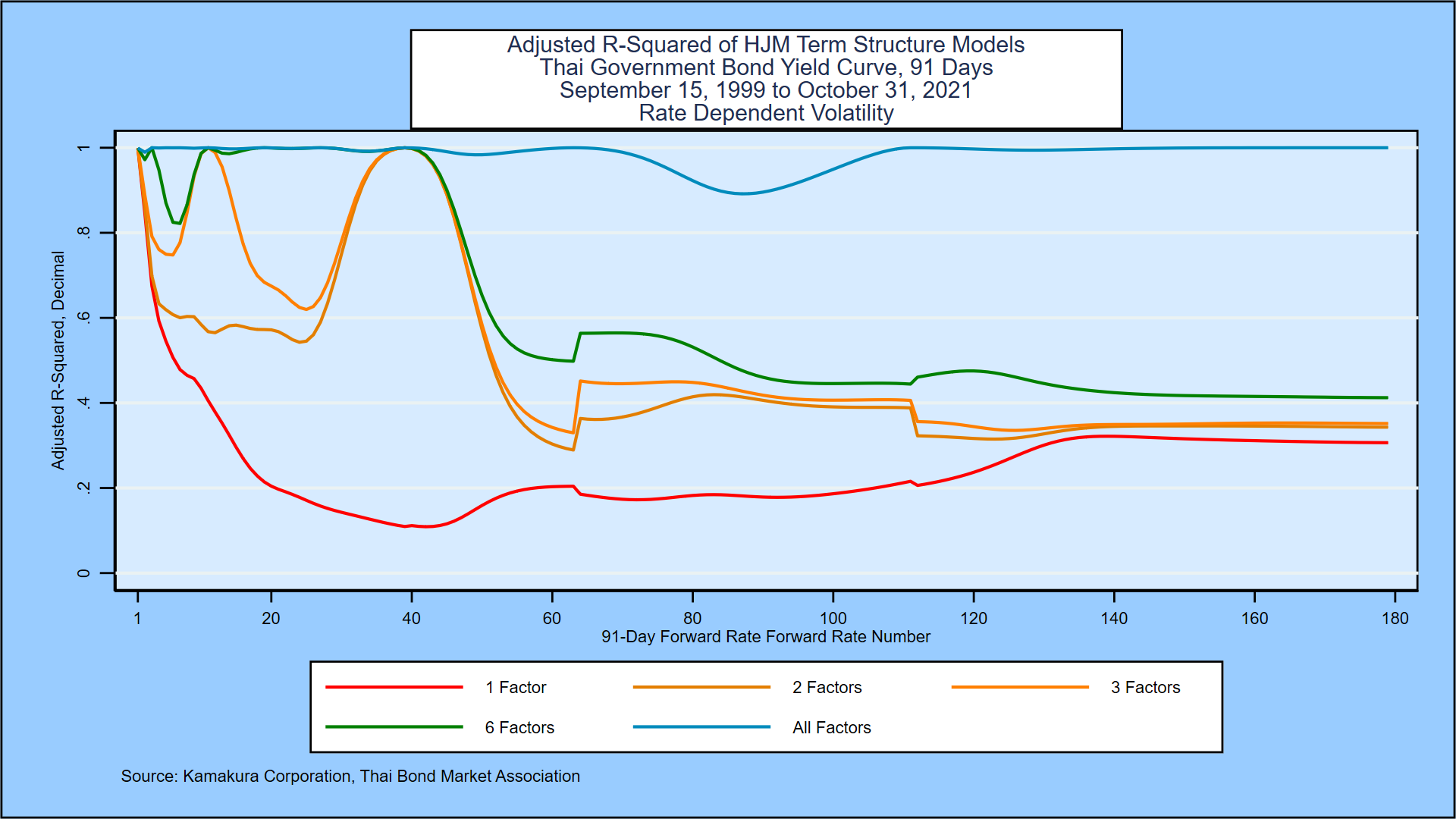

This paper analyzes the number and the nature of factors driving the movements in the Thailand Government Securities yield curve from September 15, 1999 through October 31, 2021. Consistent with prior work on Thailand and with other country studies, we confirm a number of conclusions. First, model validation of historical yields is important because those yields are the product of a third-party curve fitting process that may produce spurious indications of interest rate volatility. Second, quantitative measures of smoothness and international comparisons of smoothness provide a basis for measuring the quality of simulated yield curves. These points are particularly important in Thailand, where we show that data from the Thai Bond Market Association has smoothing issues much like those found in data from the Reserve Bank of Australia and Japan’s Ministry of Finance. Third, we outline a process for incorporating insights from the Japanese and European experience with negative interest rates into term structure models with stochastic volatility in Thailand and other countries. Fourth, we compare data availability for Thailand with broad international experience to measure the risk that a simulation beyond historical rate levels in Thailand could go awry. Finally, we illustrate the process for comparing stochastic volatility and affine models of the term structure. We conclude that stochastic volatility models, when out of sample performance is the primary interest, have a superior fit to the history of yield movements in the Thailand Government Securities market. We also recommend that Thailand Government Securities interest rate risk analysis employ the full “World” 13-country term structure model rather than relying solely on Thailand data alone.

The full text of the paper is available at this link:

Kamakura-AnUpdatedHJMModelforThailand20211031v1-20220223Footnotes

[1] Kamakura Corporation, 2222 Kalakaua Avenue, Suite 1400, Honolulu, Hawaii, USA, 96815. E-Mail dvandeventer@kamakuraco.com. The author wishes to thank Prof. Robert A. Jarrow for 28 years of conversations on this topic. The author is grateful to Daniel Dickler, Dr. Xiaoming Wang, and Theodore Spradlin for analytical and data-related assistance. The author also wishes to thank the participants at seminars organized by the Bank of Japan and the Federal Reserve Bank of San Francisco at which a paper addressing similar issues in a Japan and U.S. government bond context was presented.