This week’s simulation shows that the most likely range for the 3-month U.S. Treasury bill yield in ten years is from 0% to 1%. ...

CONNECT ME

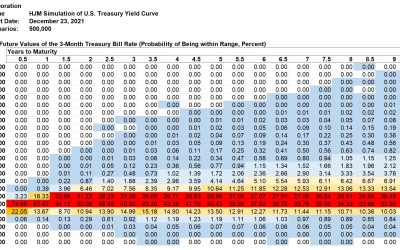

Kamakura Weekly Forecast, December 17, 2021: U.S. Treasury Probabilities 10 Years Forward

This week’s simulation shows that the most likely range for the 3-month U.S. Treasury bill yield in ten years is from 0% to 1%. ...

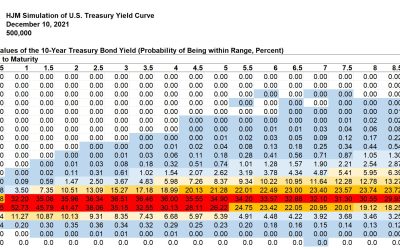

Kamakura Weekly Forecast, December 10, 2021: U.S. Treasury Probabilities 10 Years Forward

This week’s simulation shows that the most likely range for the 3-month U.S. Treasury bill yield in ten years is from 0% to 1%. ...

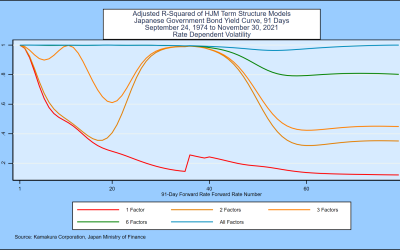

An 8-Factor Heath, Jarrow, and Morton Stochastic Volatility Model for the Japanese Government Bond Yield Curve, Using Daily Data from September 24, 1974 through November 30, 2021

Donald R. van Deventer[1] First Version: December 6, 2021 This Version: December 7, 2021 ABSTRACT Please note: Kamakura...

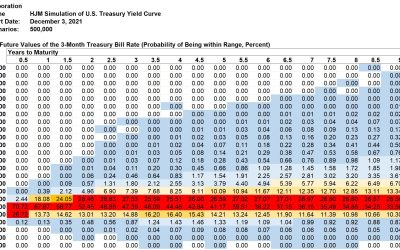

Kamakura Weekly Forecast, December 3, 2021: U.S. Treasury Probabilities 10 Years Forward

This week’s simulation shows that the most likely range for the 3-month U.S. Treasury bill yield in ten years is from 0% to 1%. ...

Goldilocks Loses

Kamakura Troubled Company Increases by 1.90% to 5.30% Credit Quality Remains Strong but Drops to the 97th Percentile NEW YORK,...